Do You Need To Send A 1099 For Donations

Your company needs to. In general when a business pays someone 600 or more the business is supposed to file a 1099 with the IRS and give copies to the recipient of the money.

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

PayPal issues their own 1099s for all PayPal donations Stripe issues their own 1099s for.

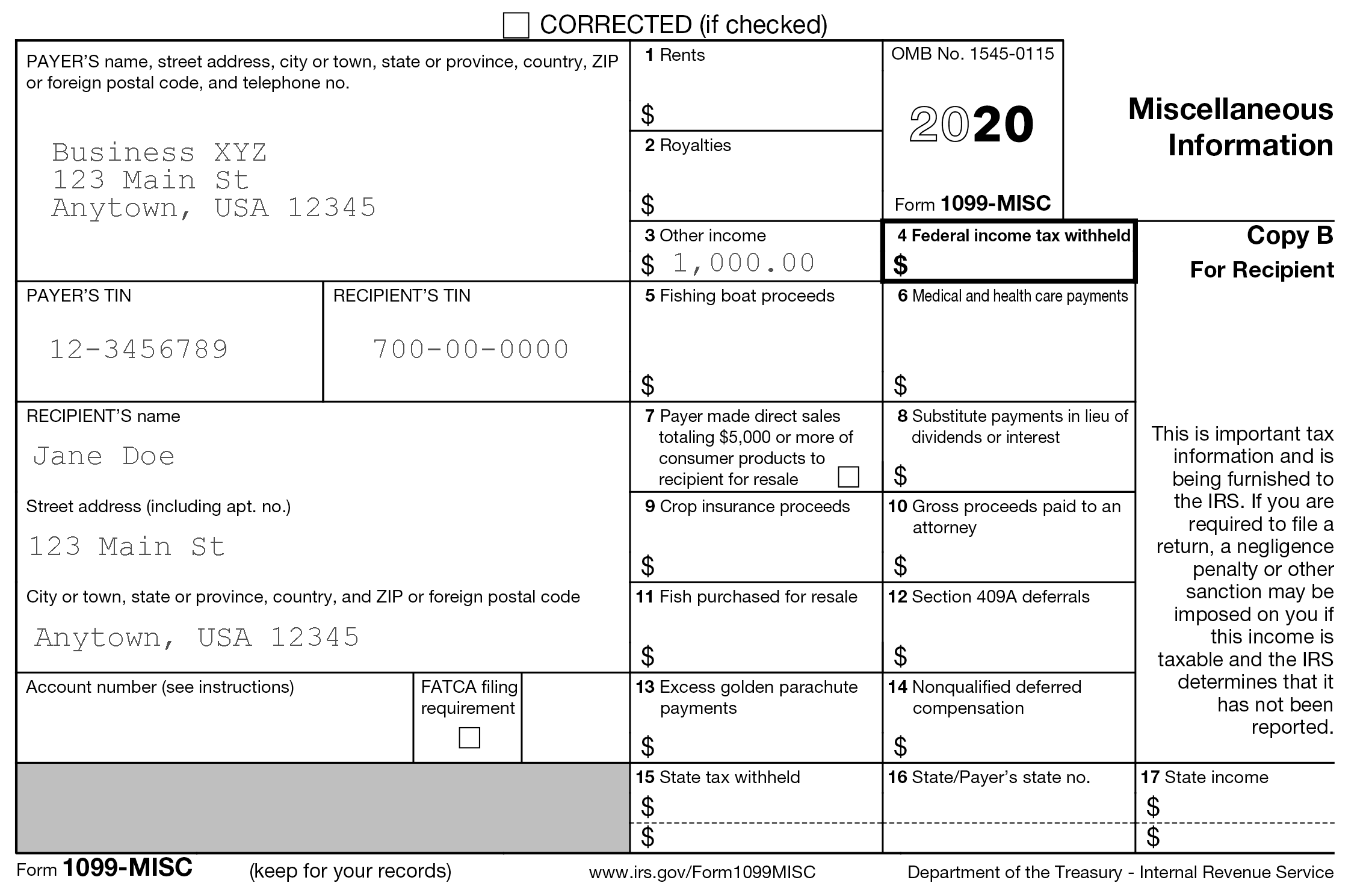

Do you need to send a 1099 for donations. Income form and given to the head of that household at the end of the year. However donations do not qualify as payments for services unless you reap a. In general you are required to send an IRS Form 1099-MISC that reports taxable income in box 7 of the form if you have paid an evangelist or minister 600 or more during the calendar year AND those payments are not being accepted and reported upon by another organization.

The 1099-Misc listed royalties rents and other miscellaneous items but its most common use was for payments to independent contractors. Should a 1099 be issued anytime our church gives benevolence funds to individuals over 600. The IRS requires that businesses report any payments of 600 or more made for services.

If you are a private person not a corporation you do not have to issue a 1099-MISC to anyone you might pay money to. Hobby income does not have any self-employment taxes and is only subject to income tax. You would receive a 1099-K if you received 200 payments max annual is 104 due to donation limitations or you got more than 20K in compensation most people could make a maximum of 35 - 4K per year if they donated twice per week unless it is a specialty antibody program.

Whether they report the income and pay taxes is up to them. In 2018 the ability to itemize expenses for hobby-related activities was suspended allowing no deductions allowed for hobby income. Generally you will have to report the information from a 1099 on your tax return.

In addition any payments aggregating 600 or more to any one payee for gross proceeds will require reporting on Form 1099-MISC. If you buy copy paper Xerox supplies paper cups mailing lists etc you will need to send 1099s to all vendors such as Wal-Mart Office Max Home Depot etc - pending future regulation to exclude certain vendors. Should that money be reflected on a 1099 misc.

Did the places that bought your blood send you 1099 forms. Should contributions to an individual be reported on a 1099 at year end. Gifts are not reported on your tax return.

Qualified If an individual receives sponsorship for displaying logos or company names on an informal basis he wont receive a Form 1099 or have to report his qualified sponsorship as income. If the charity does issue then it must also forward a copy of the 1099s to the IRS. This has the benefit of sidestepping the donors need to get a timely letter from the charity containing the magic words.

This was not a service I hope that they provided to your company. Therefore a 1099 IS REQUIRED to be sent for Medical payments. You made the payment for services in the course of your nonprofit organization.

However if the payments are being directly or indirectly received by another organization such as a missions. In past years if your organization paid a person for services who was NOT an employee you may have needed to file a 1099-Misc for the total amount given over the year. If a payment doesnt qualify for tax-exempt status a sponsored person will receive an IRS Form 1099 from his sponsor which he will have to report as income on his federal tax return.

But if they ask for a refund and the original donation was over 600 do we need to issue a 1099. Medical or Health care payments are reportable but non-employee compensation contractor payments are not reported. A non-profit is considered to be engaged in a business or trade.

You may issue a 1099-MISC but you dont have to Relatedly you will need their SSN if you want to claim the dependent care credit for part of your childcare expenses. If you made more than 600 Twitch should send you a 1099. They are going to ask the donors if they will agree to redirect the funds.

You made the payment to someone who is not your employee. Refunding Donations A parish has a restricted building fund and the parish has now decided not to move forward with the construction. Generally if the organization pays at least 600 during the year to a non-employee for services including parts and materials performed in the course of the organizations business it must furnish a Form 1099-MISC Miscellaneous Income to that person by January 31 of the following year.

Youll know that youll need to issue a form 1099 when the following four conditions are met. The United States IRS issuance threshold is 600 so if you made over 600 you should receive a 1099 if you reside in the US. A political contribution is a NON-deductible gift.

Charities can continue sending letters and disregard this proposal. We collected money for a local family.

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Irs Form 1099 R Box 7 Distribution Codes Ascensus

The Claim Number Can Be Found On A Medicare Card Or 1099 Form Reference Letter A Formal Letter Learning Letters

The Claim Number Can Be Found On A Medicare Card Or 1099 Form Reference Letter A Formal Letter Learning Letters

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients The Southern Maryland Chronicle

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients The Southern Maryland Chronicle

Taxes Tips Donations And 1099s Everything You Need To Know Streamlabs

Taxes Tips Donations And 1099s Everything You Need To Know Streamlabs

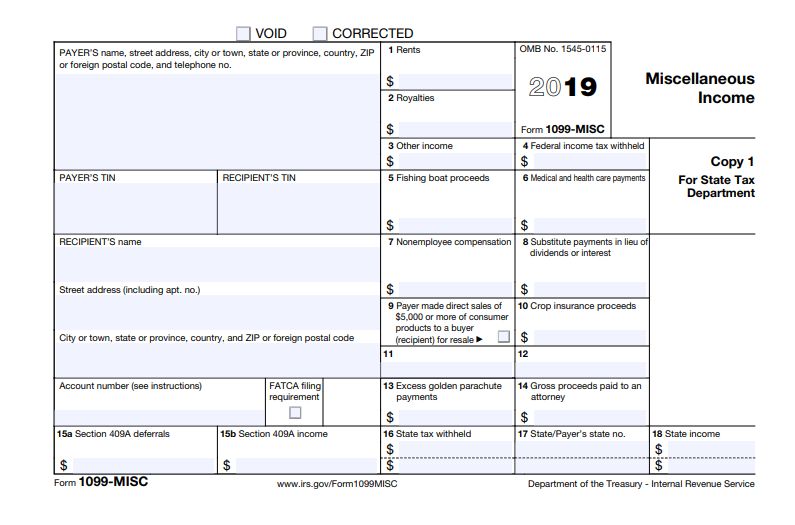

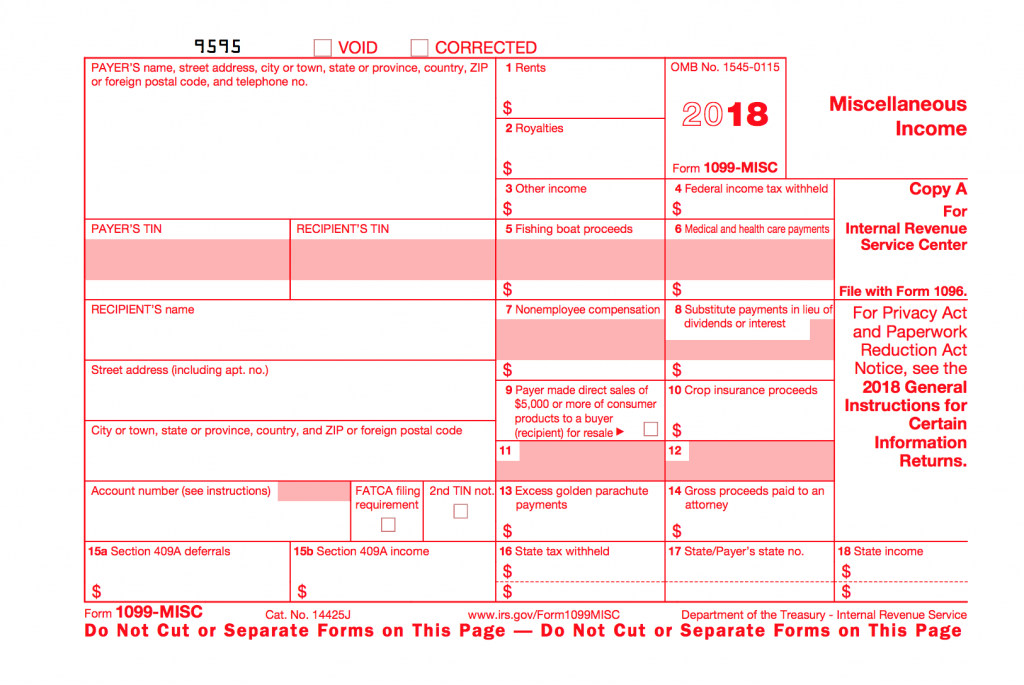

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

Understanding Your Tax Forms 2016 Ssa 1099 Social Security Benefits Tax Forms Social Security Benefits Understanding

Understanding Your Tax Forms 2016 Ssa 1099 Social Security Benefits Tax Forms Social Security Benefits Understanding

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

All About Forms 1099 Nec And 1099 K Brightwater Accounting

All About Forms 1099 Nec And 1099 K Brightwater Accounting

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

What If I Got A 1099 Misc With Only Box 7 Informat

What If I Got A 1099 Misc With Only Box 7 Informat

Do You Need To Send Out 1099s Profit Planner Books Kickstart Accounting Services Accounting Services Small Business Bookkeeping Tax Organization

Do You Need To Send Out 1099s Profit Planner Books Kickstart Accounting Services Accounting Services Small Business Bookkeeping Tax Organization

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Form W9 Box 9 Never Underestimate The Influence Of Form W9 Box 9 Employment Application Irs Forms Business Names

Form W9 Box 9 Never Underestimate The Influence Of Form W9 Box 9 Employment Application Irs Forms Business Names