Illinois 1099-r Filing Requirements

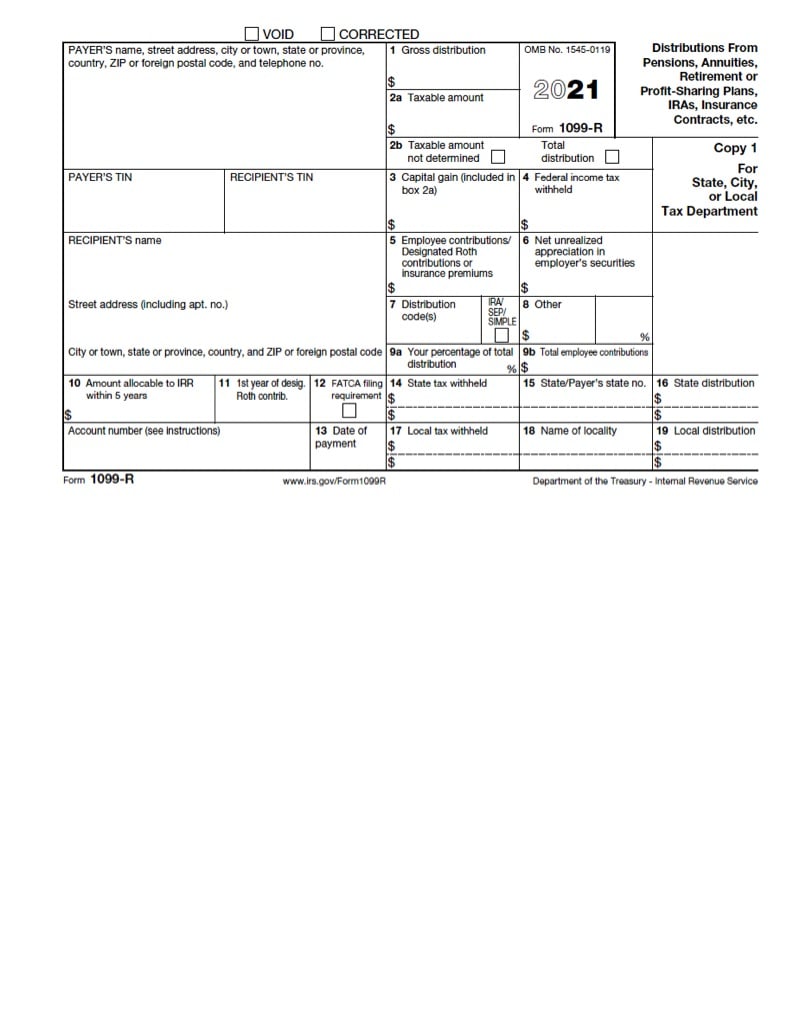

You must report on Form 1099-R corrective distributions of excess deferrals excess contributions and excess aggregate contributions under section 401a plans section 401k cash or deferred arrangements section 403a annuity plans section 403b salary reduction agreements and salary reduction simplified employee pensions SARSEPs under section 408k6. Illinois Department of Revenue Publication 110 January 2021 Forms W-2 W-2c W-2G and 1099 Filing and Storage Requirements for Employers and Payers including 1099-K Electronic Filing Requirements The information in this publication is current as of the date of the publication.

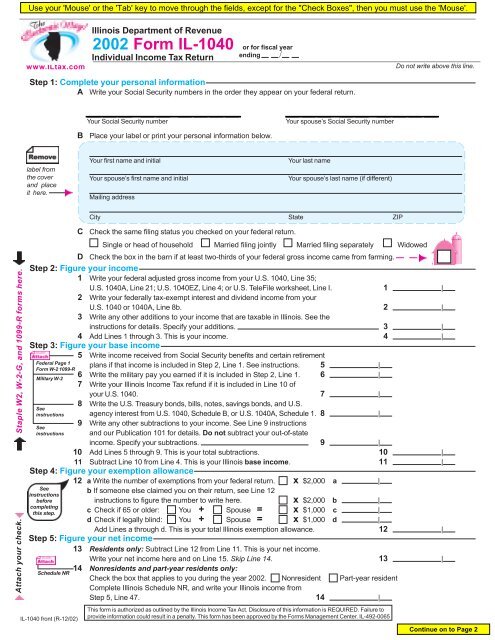

2002 Form Il 1040 Illinois Department Of Revenue

2002 Form Il 1040 Illinois Department Of Revenue

Are Forms 1099 required to be filed electronically with Illinois.

Illinois 1099-r filing requirements. The states not requiring tax filing for 1099 forms are Alaska District of Columbia Florida Illinois Iowa Louisiana Nevada New Hampshire New York Oregon South Dakota Tennessee Texas Washington and Wyoming For the states below the payer is required to print a state copy of the 1099. Any individual retirement arrangements IRAs. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from.

File Form 1099 using TaxBandits an IRS-Authorized e-file provider. 1099-K must be submitted for all recipients with at least 600 in Box 1a. If you choose to upload the file yourself in line 1 of your MA file change the 9-digit number beginning with 454to your Payers EIN before submitting to MA.

Agency a state the District of Columbia a US. An Illinois resident who worked in Iowa Kentucky Michigan or Wisconsin you must file Form IL-1040 and include as Illinois income any compensation. Reported on Form 1099-R.

Illinois requires 1099-K filing. An Illinois resident you must file Form IL-1040 if. Possession a registered securities or commodities.

Profit-sharing or retirement plans. For detailed information go to our website at taxillinoisgov. Page Content For information regarding filing and storage requirements for Forms 1099 see Publication 110 Forms W-2 W-2c W-2G and 1099 Filing and Storage Requirements for Employers and Payers including 1099-K Electronic Filing Requirements.

Electronic filing of Forms W-2G is mandatory. Please visit our website at taxillinoisgov to verify you have the. No guidance provided yet.

Learn more about the filing requirements of each. Or 1099-R Distributions From. Code Section 1007300b2 Electronic filing methods for Form W-2G.

The payments required to be reported under this election for calendar year 2021 must be reported as applicable on Form 1099-B Proceeds From Broker or Barter Exchange Transactions. When contacting SERS you need to refer to the code to the right of your name on the 1099R. Form 1099-NEC Payments of 600 or more made in the course of your business for the following.

Form 1099-G reports the amount of overpayment of state tax you have received in a tax year. What is a 1099-G issued by the Illinois Department of Revenue. With TaxBandits employers can meet all their federal and state filing requirements in one place.

Illinois requirements for 1099-NEC. Report such payments on Form W-2 Wage and Tax Statement. If you have any questions regarding your 1099R you may contact.

This overpayment could have been received as a refund carried forward as a credit applied to a subsequent tax year offered as a charitable donation or applied to other liabilities. Reportable disability payments made from a retirement plan must be reported on Form 1099-R. State tax withheld in Box 10 is the total amount Illinois state income tax withheld by request only.

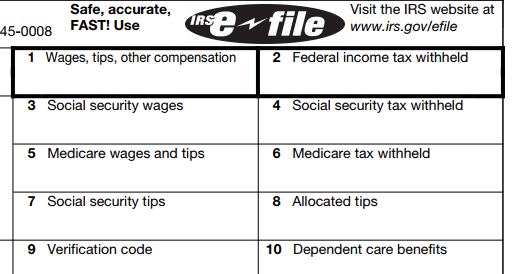

You were required to file a federal income tax return or. Form 1099-DIV Dividends and Distributions. You are required to electronically submit Forms W-2 W-2c and W-2G to Illinois.

It offers secure and accurate e. Publication 110 Forms W-2 W-2c W-2G and 1099 Filing and Storage Requirements for Employers and Payers including New 1099-K Electronic Filing Requirements. State tax withheld in Box 10 is the total amount of Illinois state income tax withheld by request only.

TaxBandits supports filing of W-2 1099 and 1095 Forms directly with the state and mail copies to employeesrecipients on-time. Click here to look up your 1099-G on MyTax Illinois. The Illinois Department of Revenue does not accept Forms.

However the IRS still requires you to file Form 1099 to report payments and the taxes withheld for each of your recipients for the year. The state transitioned to voluntary reporting in tax year 2017. Form 1099-R if DE state tax is withheld.

If you are unable to do so you can complete Form IL-900-EW to request a waiver. Waiting on further instructions. Annuities pensions insurance contracts survivor.

The state of Illinois does not require you to file Form 1099. There is no special reporting for qualified charitable. Recommended filing method.

You are not required to file Form 1099-INT for payments made to certain payees including but not limited to a corporation a tax-exempt organization any individual retirement arrangement IRA Archer medical savings account MSA Medicare Advantage MSA health savings account HSA a US. You were not required to file a federal income tax return but your Illinois base income from Line 9 is greater than your Illinois exemption allowance. Illinois State Filing Requirements for 1099-K.

See Publication 110 Forms W-2 W-2c W-2G and 1099. 1099-OID Original Issue Discount. Generally do not report payments subject to withholding of social security and Medicare taxes on this form.

During 2020 if your business paid 600 or more cumulatively to a non-incorporated vendor for services freelancesubcontract services professional fees or rent then you are required to issue them a 1099 by January 31 st of 2021. Electronic Requirements for Illinois Withholding Income Tax. The state of Illinois does not require 1099-MISC reporting at this time.

Forms 1099-NEC MISC INT DIV K and R. If you have questions regarding your 1099R you may contact the IRS your tax preparer or SERS.

Https Www2 Illinois Gov Rev Forms Misc Documents Ef Il 8453 Pdf

2020 Illinois Tax Filing Season Began Monday January 27 The Crusader Newspaper Group

2020 Illinois Tax Filing Season Began Monday January 27 The Crusader Newspaper Group

Https Www2 Illinois Gov Rev Research Publications Bulletins Documents What S New For Illinois Income Taxes Pdf

Https Www Uaex Edu Business Communities Business Entrepreneurship Media 2017 20workbook 20vol 20a Pdf

Form 1099 State Filing Requirements 1099 Misc Deadlines Tax1099 S

Form 1099 State Filing Requirements 1099 Misc Deadlines Tax1099 S

2021 Winter Topics Report Newsletter Teachers Retirement System Of The State Of Illinois

2021 Winter Topics Report Newsletter Teachers Retirement System Of The State Of Illinois

Illinois Employers Required To File Electronically

Illinois Employers Required To File Electronically

2020 Winter Topics Report Newsletter Teachers Retirement System Of The State Of Illinois

Illinois Foreign Llc Registration Get An Illinois Certificate Of Authority

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Year End E Filing Requirements For Illinois Blog Taxbandits

Year End E Filing Requirements For Illinois Blog Taxbandits

Year End E Filing Requirements For Illinois Blog Taxbandits

Year End E Filing Requirements For Illinois Blog Taxbandits

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Misc Form Reporting Requirements Chicago Accounting Company

Welcome To General Assembly Retirement System

Welcome To General Assembly Retirement System

Https Www Srs Illinois Gov Pdfiles Tier 201 Tier1retireehb 10 Pdf

Https Www2 Illinois Gov Rev Research Publications Pubs Documents Pub 110 Pdf

Https Www Srs Illinois Gov Pdfiles 1099r 20faqs Pdf