Short Form Merger Business Definition

A short form merger also known as a parent - subsidiary merger is the combination of a parent company and a subsidiary previously the target firm that is not necessarily wholly owned by the parent. Either entity can be designated as the survivor of the merger.

Mergers And Acquisitions Powerpoint Template Slidesalad Powerpoint Templates Powerpoint Design Templates Powerpoint

Mergers And Acquisitions Powerpoint Template Slidesalad Powerpoint Templates Powerpoint Design Templates Powerpoint

State statutes typically mandate that the parent entity must own at least 90 of the subsidiary before.

Short form merger business definition. A merger takes place when two or more businesses want to join forces and become a single entity. The parent company is typically required to have an extremely large stake in the subsidiary a typical requirement is that the parent own 80 or 90 of each class of stock issued by the subsidiary. Inventory equipment stock and fixtures are tangible items while intangible items may be goodwill the name or patents.

A short-form merger occurs in the case of a parent corporation who is merging with a subsidiary company of its own. If the parent owns less than all of the outstanding shares then the board of directors of the subsidiary must also approve the merger. The short-form merger is a statutory procedure by which a parent corporation can merge with its ninety percent-owned subsidiary through a simple board resolution1 Since neither 1.

The firms that agree to merge are roughly equal in terms of size customers and scale of. California Corporations Code section 1110 allows the merger of a subsidiary corporation into the parent by a simplified procedure if the parent owns 100 percent of the outstanding shares of the subsidiary. It requires Company A to already own around 90 percent of Bs stock though some states set a slightly different percentage.

A A parent organization that owns at least 90 percent of the outstanding ownership or membership interests of each class and series of each of one or more subsidiary organizations may merge with one or more of the subsidiary organizations as provided by. The surviving entity owns all the assets liabilities and obligations of. The requirements for a short form merger are set forth in the statutes of the applicable state government.

What is the definition of merger. A short-form merger does not require approval of the stockholders of the subsidiary. What Does Merger Mean.

Short-form Merger Delaware statutorily provides a mechanism for mergers where a parent corporation owning 90 or more of each class of stock in a subsidiary may merge with the entity and force the minority shareholders out for a fair value cash buyout. A reverse triangular merger is a new company that forms when an acquiring company creates a subsidiary that subsidiary purchases the target company and the target company then absorbs the. The merger is accomplished by filing a Certificate of Ownership with the Secretary of State.

Many businesses may take part in a merger but at the end of the day there is only one survivor. A short form merger combines a parent company and a subsidiary that is substantially owned by the parent. A short-form merger may take place in situations in which the stockholder approval process is not necessary.

A merger is a combination of two or more business entities in which the assets and liabilities of all the entities are transferred to one which continues in existence while all the others cease to exist. Short-Form Merger Also known as a parent-subsidiary merger a short-form merger is a merger between a parent company and its substantially but not necessarily wholly owned subsidiary with either the parent company or the subsidiary surviving the merger. A short-form merger is only possible if the parent owns at least 90 of the outstanding shares of each class of the subsidiary to be merged.

The short-form merger is another useful option because it dispenses with much of the ordinary merger paperwork. See Code of Ala. Short Form Merger Certificate of Ownership.

A merger is the combination of two companies into one by either closing the old entities into one new entity or by one company absorbing the other. In other words two or more companies are consolidated into one company. I a traditional long-form merger transaction negotiated with the controlled board that recommends the merger to its shareholders who then vote on the merger or ii a tender offer made directly to the minority shareholders followed by a statutory short-form merger to cash out any remaining minority.

As a continuation of the previous article. Controlling shareholders have two main methods of obtaining additional shares. Although not available in all states state statutes will typically mandate that the parent entity owns at least 90 of the subsidiary before a short form merger can be enacted.

A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity.

Business Growth Takeovers And Mergers

Business Growth Takeovers And Mergers

Conglomerate Merger Advantages And Disadvantages Of Conglomerate Merger

Conglomerate Merger Advantages And Disadvantages Of Conglomerate Merger

Wat Meaning What Does The Term Wat Stand For 7esl Latin Root Words Root Words Words

Wat Meaning What Does The Term Wat Stand For 7esl Latin Root Words Root Words Words

Financial Management Toolkit Corporate Strategy Consulting Business Financial Management

Financial Management Toolkit Corporate Strategy Consulting Business Financial Management

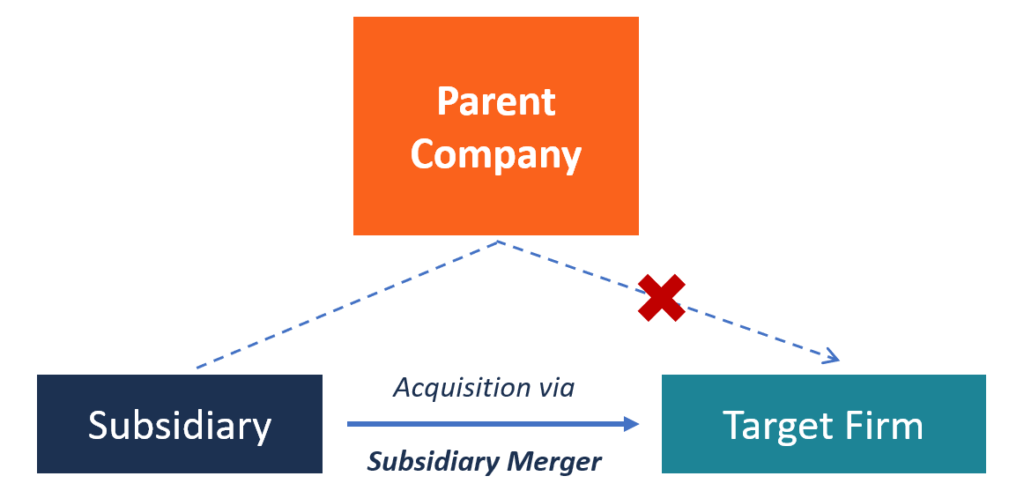

Subsidiary Merger Overview Types Pros And Cons

Subsidiary Merger Overview Types Pros And Cons

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

In The Process Of Mergers And Acquisitions We Work In The Analyses And Insights And Access The Information And Conclusions About How Merger Service Analysis

In The Process Of Mergers And Acquisitions We Work In The Analyses And Insights And Access The Information And Conclusions About How Merger Service Analysis

M A Glossary Important Terms Defined For Mergers Acquisitions

M A Glossary Important Terms Defined For Mergers Acquisitions

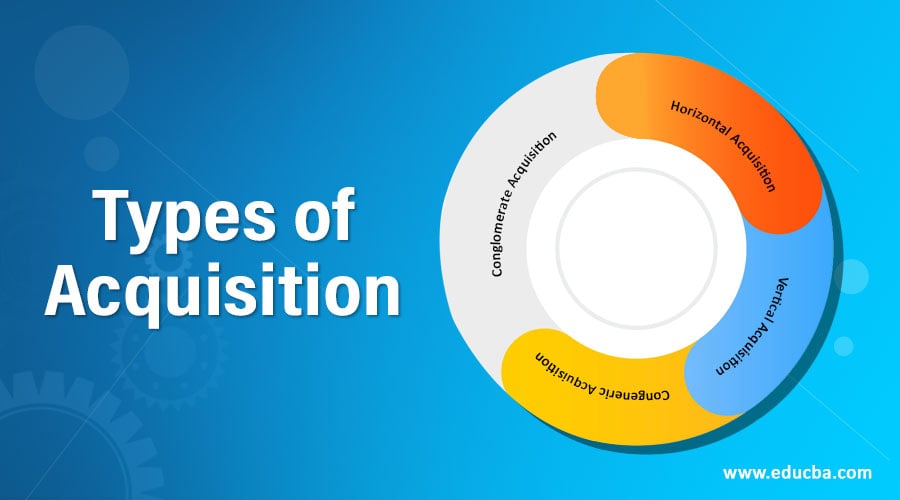

Types Of Acquisition Top 4 Types Of Acquisition With Purpose

Types Of Acquisition Top 4 Types Of Acquisition With Purpose

Merger Overview Types Advantages And Disadvantages

Merger Overview Types Advantages And Disadvantages

Types Of Mergers Learn About The Different Types Of M A

Types Of Mergers Learn About The Different Types Of M A

Mergers Vs Acquisitions Accounting And Finance Financial Life Hacks Financial Literacy

Mergers Vs Acquisitions Accounting And Finance Financial Life Hacks Financial Literacy

Mergers And Acquisitions Powerpoint Template Slidesalad Process Flow Chart Template Process Flow Chart Powerpoint Templates

Mergers And Acquisitions Powerpoint Template Slidesalad Process Flow Chart Template Process Flow Chart Powerpoint Templates

Types Of Acquisition Top 4 Types Of Acquisition With Practical Examples

Types Of Acquisition Top 4 Types Of Acquisition With Practical Examples

Mergers And Acquisitions Ma Process And Steps Merger Portfolio Strategy Life Cycles

Mergers And Acquisitions Ma Process And Steps Merger Portfolio Strategy Life Cycles

Types Of Mergers And Acquisitions A Complete Summary

Types Of Mergers And Acquisitions A Complete Summary

Difference Between Merger And Consolidation Difference Between

Acquisition Structure Definition Types Key Takeaways

Acquisition Structure Definition Types Key Takeaways

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep