How To Request A 1099 G Form Colorado

If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. You can receive a copy of your 1099-G Form multiple ways.

W 9 Form Colorado 2016 Vincegray2014

W 9 Form Colorado 2016 Vincegray2014

MyUI Claimant ofrece la información de impuestos al instante y a su disposición las 24 horas del día.

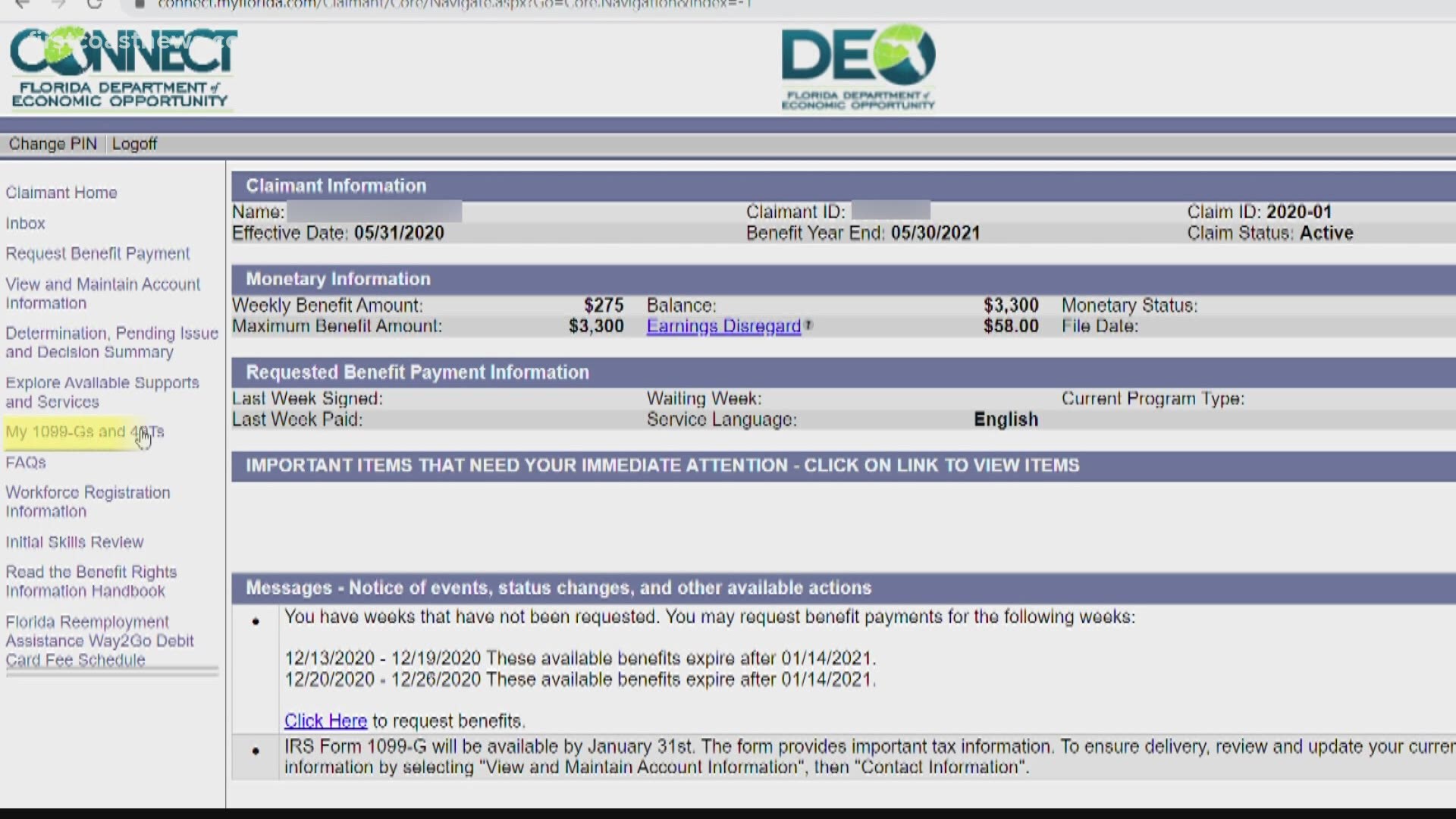

How to request a 1099 g form colorado. You can log-in to CONNECT and go to My 1099- G in the main menu to view the last five years of your 1099-G Form document. Many who received unemployment benefits last year are now depending on tax returns but some are still waiting to get their 1099-G forms from the Colorado Department of Labor and Employment CDLE. You will need this information when you file your tax return.

We will mail you a paper Form 1099G if you. Please provide your social security number SSN. You can access your Form 1099G information in your UI Online SM account.

The fastest way to receive a copy of your 1099-G Form is by selecting electronic as your preferred method for correspondence. The form is in postcard format. Amounts on this form include.

You may send the form back to NYSDOL via your online account by fax or by mail. If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof. Below are the steps you can take if you received a 1099-G but didnt receive unemployment benefits.

A separate copy of your 1099-G is sent to the IRS. About DOR Careers Locations Taxpayer Bill of Rights Fraud Referral Form Your Government. You must complete all fields to have your request processed.

Colorado income tax refund you received the prior year. Follow the instructions on the bottom of the form. If you did not receive your 1099-G log in to wwwcoloradouigovMyUI to get a copy.

Once NYSDOL receives your completed Request for 1099-G Review form it will be reviewed and we will send you an amended 1099-G tax form. Department of Unemployment Assistance. We need your SSN in order to locate your unemployment claim.

Make a report with CDLE using the Report Invalid 1099 form. This form is being completed on a secure site connected to MyUI. Y ou must put the entire SSN in this field in order for us to send you a replacement 1099.

31 of the year after you collected benefits. Although the FYIs represent a good faith effort to provide accurate and complete tax. FYIs provide general information concerning a variety of Colorado tax topics in simple and straightforward language.

State Organizations Elected Officials State Jobs. If you do not receive the 1099-G in the mail sign up for access and log in to your account through our Revenue Online service to view the amount of last years Colorado refund that was reported to you on Form 1099-G. You may print a copy of 1099-G forms for past years at any time.

A 1099-G income tax form was mailed to anyone who received a benefit payment during 2016. How to Request a 1099G Electronicallypdf 77446 KB. It is issued by government agencies for use in filling out your federal income tax return.

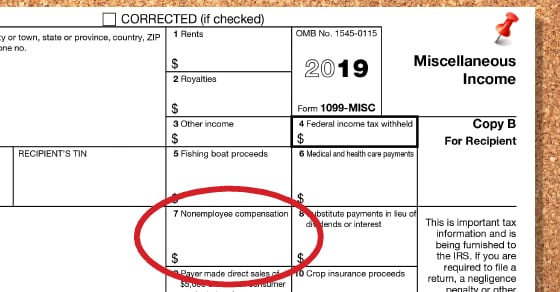

Form 1099-G Certain Government Payments is an income tax statement to notify recipients about the income they received during the previous year. How to Request a 1099-G Electronically Instructional Guide This instructional document explains how to request a 1099-G electronically. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year.

The IRS requires the Colorado Department of Revenue to provide Form 1099-G to taxpayers who may have itemized deductions on their federal return the previous year. A 1099G is issued if you received 10 or more in gross unemployment insurance payments. Pacific time except on state holidays.

Florida Department of Economic Opportunity 1099-G Request Form. If there is no record of a 1099-G in your account you may not have received a taxable income tax refund last year. Please fill out the following form to request a new 1099 form.

The Colorado Department of Revenue 1099-Gs call 303-238-SERV 7378. Reread the number you enter and make sure it is correct. If it is not available online in the portal and you didnt receive it via mail I think they were all supposed to be mailed this year you can request a copy here.

This form is available online through MyUI. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan. If you disagree with any of the information provided on your 1099-G tax form you should complete the Request for 1099-G Review.

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

Individual Wage Withholding W 2 1099 Statements Department Of Revenue Taxation

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

Colorado Form 1099 G Vincegray2014

Colorado Form 1099 G Vincegray2014

Colorado Received Reports Of More Than 11 000 Tax Forms Tied To Fraudulent Unemployment Claims

Colorado Received Reports Of More Than 11 000 Tax Forms Tied To Fraudulent Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Small Business 1099 Misc Reporting Requirements Dalby Wendland Co P C

Small Business 1099 Misc Reporting Requirements Dalby Wendland Co P C

Https Www Colorado Gov Pacific Sites Default Files Federal 20reporting 20guide 20cy 202018 Pdf

How To Get Your 1099 G Tax Form If You Received Benefits

How To Get Your 1099 G Tax Form If You Received Benefits

Floridians Report Tax Documents With Inaccurate Information 9news Com

Floridians Report Tax Documents With Inaccurate Information 9news Com

Colorado Form 1099 G Vincegray2014

Colorado Form 1099 G Vincegray2014

Scammers Continue To Take Advantage Of Unemployment Benefits As States Including Colorado Crack Down On Fraud Business Montrosepress Com

Scammers Continue To Take Advantage Of Unemployment Benefits As States Including Colorado Crack Down On Fraud Business Montrosepress Com

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Colorado Form 1099 G Vincegray2014

Colorado Form 1099 G Vincegray2014

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

How Scammers Targeted Colorado S Unemployment System And What The State Is Doing About It Colorado Springs Colorado Eminetra

How Scammers Targeted Colorado S Unemployment System And What The State Is Doing About It Colorado Springs Colorado Eminetra

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Fort Morgan Times

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Fort Morgan Times