Identify And Describe Three Types Of Business Ownership For Self Employment

The employer or business owner controls or has the right to control what workers do and how they perform their jobs. Identify the most suitable type of ownership appropriate to your business idea.

People Who Are Self Employed Tend To Be Happiest When Compared To People In Other Types Of Profess Freelance Writing Small Business Ownership Start Up Business

People Who Are Self Employed Tend To Be Happiest When Compared To People In Other Types Of Profess Freelance Writing Small Business Ownership Start Up Business

In a general partnership all partners have unlimited liability while in a limited partnership at least one partner has liability limited only to his or her investment while at least one other partner has full liability.

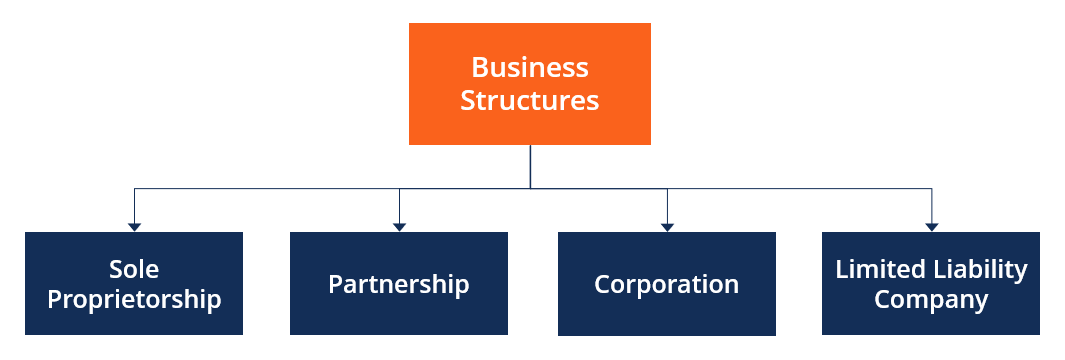

Identify and describe three types of business ownership for self employment. Any corporation that under United States federal income tax law is taxed separately from its owners. The employer or business owner controls aspects of the workers jobs such as how theyre paid if theyre reimbursed for expenses and who provides the workers tools and supplies. There are four principal self employed business structures.

Other Types of Business Ownership. Sole trader partnership and limited company - but be warned your selection will have. Its important to understand that not all companies operate in the same way and there are three main types of business that those seeking self-employment can look to establish.

In a sole proprietorship the individual owner has unlimited personal liability for all debts of the business. A business that is owned and operated by two or more people -- and the least used form of business organization in the United States. There are two basics forms of partnerships general and limited.

Well look at two of these options. In addition to the three commonly adopted forms of business organizationsole proprietorship partnership and regular corporationssome business owners select other forms of organization to meet their particular needs. The first thing you have to consider is what type of entity youre going to create.

Sole proprietorship a partnership a limited liability company or a corporation. One who owns shares of stock. Since no distinction is made between the owners personal assets and the assets used in the business creditors may take either or both to satisfy business obligations.

The decision comes down generally to four main choices. Describe three types of Business Ownership explaining one advantage and one disadvantage of each. It is the portion of corporate profits paid out to stockholders.

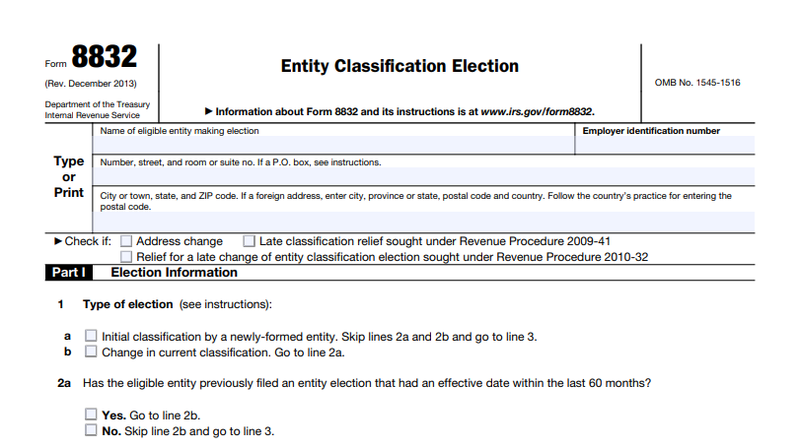

Dividends are payments made by a corporation to its shareholder members. For this outcome you will identify and describe different types of business ownership and the legal factors involved in self-employment. The corporation breaks down into two categories S corporation and C corporation.

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

Self Employment Income Statement Template Beautiful Business Profit And Loss Statement For Self E Profit And Loss Statement Income Statement Statement Template

Self Employment Income Statement Template Beautiful Business Profit And Loss Statement For Self E Profit And Loss Statement Income Statement Statement Template

Think This Is Accurate What Are Your Thoughts Learn Affiliate Marketing Thinking Of You Quotes Self Business

Think This Is Accurate What Are Your Thoughts Learn Affiliate Marketing Thinking Of You Quotes Self Business

Taxes For The Location Independent Rv Owner Digital Nomad Self Employment Business Tax Deductions Small Business Tax

Taxes For The Location Independent Rv Owner Digital Nomad Self Employment Business Tax Deductions Small Business Tax

Sample One Page Business Plan Template Self Employment Entrepreneur Small Business D Small Business Plan One Page Business Plan Small Business Plan Template

Sample One Page Business Plan Template Self Employment Entrepreneur Small Business D Small Business Plan One Page Business Plan Small Business Plan Template

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

Free Business Expense Spreadsheet Business Tax Deductions Small Business Tax Small Business Tax Deductions

Free Business Expense Spreadsheet Business Tax Deductions Small Business Tax Small Business Tax Deductions

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Spreadsheet Template Business

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Spreadsheet Template Business

10 Can T Miss Tax Deductions For Small Businesses Self Employed Persons Tax Deductions Deduction Health Savings Account

10 Can T Miss Tax Deductions For Small Businesses Self Employed Persons Tax Deductions Deduction Health Savings Account

Profit And Loss Statement For Self Employed Profit And Loss Statement Statement Template Bank Statement

Profit And Loss Statement For Self Employed Profit And Loss Statement Statement Template Bank Statement

7 Self Employment Tax Forms For Home Business Owners Small Business Tax Tax Forms Business Budget Template

7 Self Employment Tax Forms For Home Business Owners Small Business Tax Tax Forms Business Budget Template

6 Types Of Self Employed Or Freelance Flexible Workers Flexjobs

6 Types Of Self Employed Or Freelance Flexible Workers Flexjobs