Are Unreimbursed Business Expenses Deductible In 2019

Most employees cant deduct unreimbursed expenses on their taxes. WASHINGTON The Internal Revenue Service today issued guidance for taxpayers with certain deductible expenses to reflect changes resulting from the Tax Cuts and Jobs Act TCJA.

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

It also explains when you can deduct capital expenses and special care expenses for disabled persons.

Are unreimbursed business expenses deductible in 2019. They must complete Form 2106 Employee Business Expenses. For an expense to be ordinary it must be accepted in your job. Qualified education expenses for purposes of 529 plans are no longer limited to.

For many employees this ability to deduct employment-related expenses that were not. Feb 22 2018 However with tax reform all miscellaneous 2 expenses including unreimbursed employee expenses are not allowed between 2018 and 2025. And no deduction is allowed for transportation expenses.

2 days ago This article was published by the IRS. The TCJA eliminates it for tax years 2018 through 2025. Form 1040 Schedule A.

Dec 23 2019 December 23 2019 by Carolyn Richardson EA MBA. Expenses such as union dues work-related business travel or professional organization dues are no longer deductible even if the employee can itemize deductions. Unreimbursed employee business expenses tax preparation fees investment expenses safe deposit box etc.

For 2018-2025 unreimbursed business expenses are not deductible by employee b. Jan 03 2021 The deduction for unreimbursed employee business expenses was one of those that were affected. Jan 31 2020 If you are organized under another business form then the business may deduct the ordinary and necessary expenses of operating or conducting that business.

Revenue Procedure 2019-46 PDF posted today on IRSgov updates the rules for using the optional standard mileage rates in computing the deductible costs of operating an automobile for business charitable medical or moving expense. Jul 17 2020 Unreimbursed business expenses combined with the other miscellaneous itemized deductions reported on US. An expense is ordinary if it is common and accepted in your trade business or profession.

The expense must be paid during the tax year you are filing. Deductions for employee transportation fringe benefits eg parking and mass transit are denied. You can still claim this deduction if you havent yet filed your 2017 tax return however.

It must be directly related to your job and it should be common and necessary to your line of work. You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year for carrying on your trade or business of being an employee and ordinary and necessary. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators.

As the 2019 tax season takes off businesses and employees have untangled the full impact of tax reform. For New York purposes Form IT-196 lines 5 6 and 7 your state and local taxes paid in 2020 are not subject to the. Oct 06 2020 Although its not legally required businesses should reimburse their employees when they incur necessary business expenses.

Expenses are deductible only if the reservists pay for meals and lodging at their official military post and only to the extent the expenses exceed Basic. Jan 08 2021 There are three criteria that must be true in order to deduct unreimbursed employee expenses. Tax reform has slashed the ability to deduct certain business expenses generated by the employer and the employee and unreimbursed employee expenses by the individual.

To claim unreimbursed travel expenses reservists must be stationed away from the general area of their job or business and return to their regular jobs once released. You dont have to reduce your expenses if youre claiming the federal credit for business or health coverage. The deduction for business meal expenses is limited to 50 of the qualified expenses ii.

The current 50 limit on the deductibility of business meals is expanded to meals provided through an in-house cafeteria or otherwise on the premises of the employer. Form 1040 Schedule A must exceed 2 of the federal adjusted gross income reported on US. Under federal law deductions for entertainment expenses are disallowed.

Jan 02 2020 ical and Dental Expenses describes the types of expenses you can and cant deduct in greater detail. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. But if you have unreimbursed business expenses as an employee what used to be known as Employee Business Expenses EBE then those expenses are generally no longer deductible for the 2019 tax year.

If you were an employee who was used to deducting your unreimbursed employee business expenses EBE you might have been unpleasantly surprised while preparing your 2018 federal tax return when you realized this deduction had gone away. Dec 23 2020 For federal purposes your total itemized deduction for state and local taxes paid in 2020 is limited to a combined amount not to exceed 10000 5000 if married filing separateIn addition you can no longer deduct foreign taxes you paid on real estate. The 50 limit is imposed on whomever employer or employee ultimately pays the expense 1.

IR-2019-183 November 14 2019. The overall limitation on itemized deductions the Pease Limitation is suspended until 2025.

Organize Small Business Taxes Plus Free Printables Christinas Adventures Small Business Tax Business Tax Business Marketing

Organize Small Business Taxes Plus Free Printables Christinas Adventures Small Business Tax Business Tax Business Marketing

Self Employed Business Tax Deduction Sheet A Success Of Your Business The Best Insurance Company See Th Business Tax Deductions Small Business Tax Business Tax

Self Employed Business Tax Deduction Sheet A Success Of Your Business The Best Insurance Company See Th Business Tax Deductions Small Business Tax Business Tax

Tax Tips For Home Business Owners Self Employed Expenses List Home Business Tax Deductions Home Busines Filing Taxes Business Tax Deductions Business Tax

Tax Tips For Home Business Owners Self Employed Expenses List Home Business Tax Deductions Home Busines Filing Taxes Business Tax Deductions Business Tax

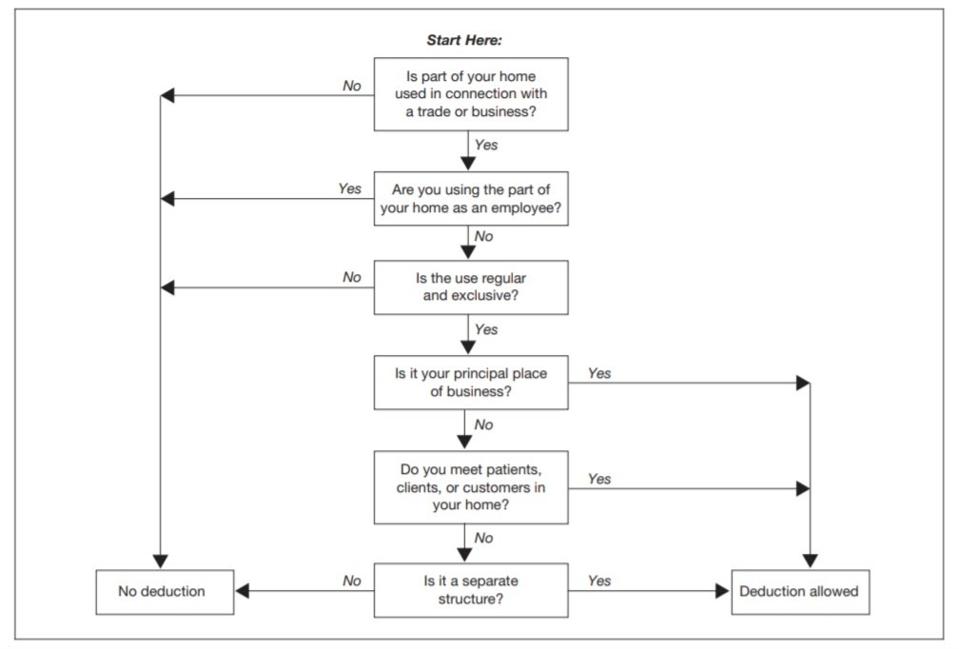

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

Ir 2018 251 Internal Revenue Service Cpa Moving Expenses

Ir 2018 251 Internal Revenue Service Cpa Moving Expenses

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

4 Surefire Ways To Off Set Your Blogging Costs Make Side Money Vacation Money Pinterest For Business

4 Surefire Ways To Off Set Your Blogging Costs Make Side Money Vacation Money Pinterest For Business

Hair Stylist Salon Tax Deduction Checklist Simply Organic Beauty Salons Salon Business Hair Salon Business

Hair Stylist Salon Tax Deduction Checklist Simply Organic Beauty Salons Salon Business Hair Salon Business

Deduct Car Expenses Small Business Tax Deductions Business Tax Deductions Small Business Tax

Deduct Car Expenses Small Business Tax Deductions Business Tax Deductions Small Business Tax

Do You Understand Your W 2 Ageras Tax Tricks Income Tax Return Irs Tax Forms

Do You Understand Your W 2 Ageras Tax Tricks Income Tax Return Irs Tax Forms

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service

2019 Tax Deadline Calendar Infographic Ageras Bookkeeping Business Small Business Bookkeeping Tax Tricks

2019 Tax Deadline Calendar Infographic Ageras Bookkeeping Business Small Business Bookkeeping Tax Tricks

2019 Irs Standard Mileage Rate Irs Mileage Employee Management

2019 Irs Standard Mileage Rate Irs Mileage Employee Management

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Schedule C Form 1040 2021 Who Has To File Irs Tax Forms Irs Taxes Tax Forms

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Important 2019 Dates For The Self Employed Small Business Bookkeeping Employment Application Small Business Finance

Important 2019 Dates For The Self Employed Small Business Bookkeeping Employment Application Small Business Finance

Hair Stylist Salon Tax Deduction Checklist Simply Organic Beauty Hair Salon Business Hairstylist Quotes Salons

Hair Stylist Salon Tax Deduction Checklist Simply Organic Beauty Hair Salon Business Hairstylist Quotes Salons

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Tax Deductions Home Based Business Deduction

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Tax Deductions Home Based Business Deduction