Business Activity Statement (bas) Reporting Requirements

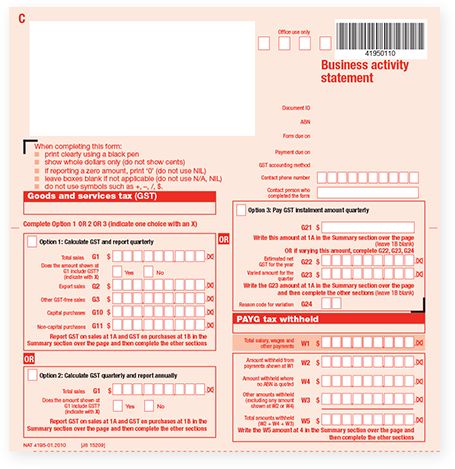

The older Business Activity Statement explains the old report including how to switch to the new one. The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period.

Common Errors To Avoid On Your Bas Smf Accounting Services

Common Errors To Avoid On Your Bas Smf Accounting Services

Through a registered tax or BAS agent.

Business activity statement (bas) reporting requirements. On the basis of this report various business taxes are paid to the relevant tax office. A Use a black pen and print clearly. Complete and return by the due date on your BAS along with any payment due.

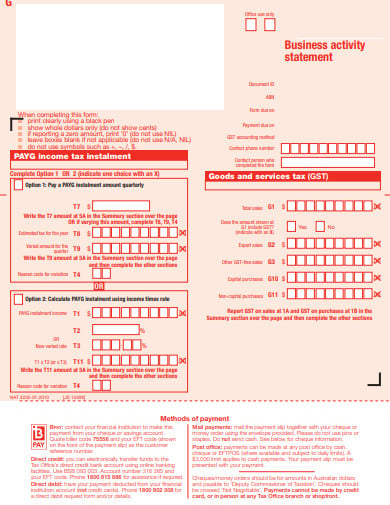

Goods and services tax GST pay as you go PAYG instalments. Your BAS will help you report and pay your. Points to be remembered while filling the Business Activity Statement.

Lodge your BAS to the ATO at regularly intervals either monthly quarterly or annually. You do this by completing a business activity statement BAS. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS.

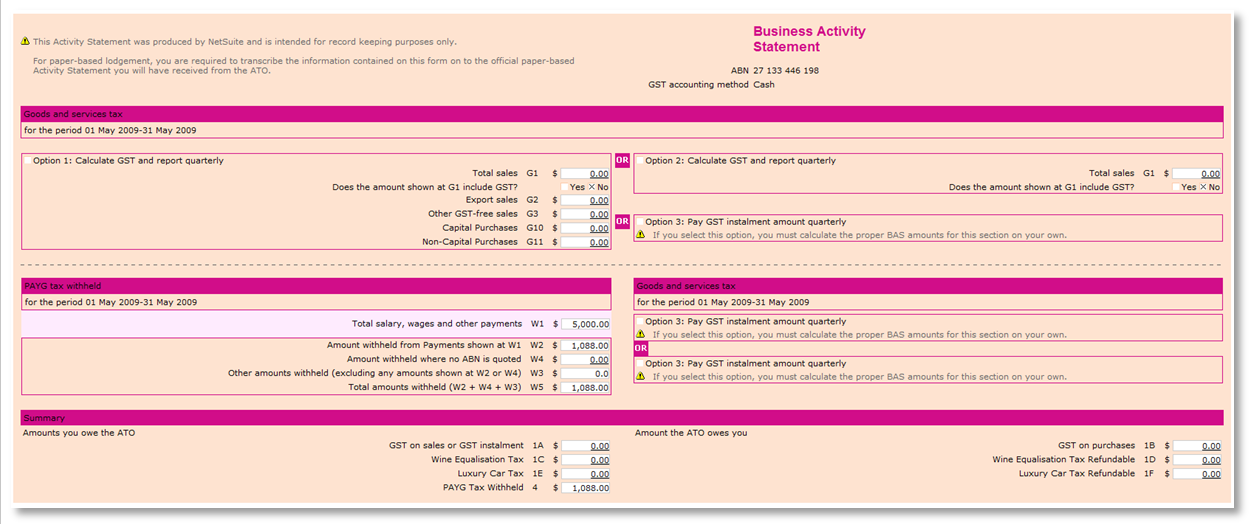

It reports a business goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other tax obligations. A business activity statement is a report that is submitted by a business to the Australian Taxation Office ATO. You can lodge your BAS.

Information you will need Youll need a record of how much GST you collected on sales and how much was paid on purchases. Make sure to include the reporting period the Document ID your Australian Business Number ABN and your signature on the BAS form. Ascertaining or advising about the liabilities obligations or entitlements of a client under a BAS provision.

If you are a business owner then you are responsible for ensuring that you comply with all your businesss GST obligations. If you report and pay GST quarterly and your GST turnover is 10 million or more you must report amounts at the following labels on your activity statement each quarter. If your GST turnover is less than 10 million you generally report GST using the default Simpler BAS reporting method.

You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. The BAS contains details about the various types of taxes that may need to be paid by a business. B complete the labels where you have something to report leave other labels blank c round down to whole-dollar amounts dont include cents d dont report.

Even if you cant pay by the due date you still need to lodge your BAS on time. A Business Activity Statement BAS summarises the tax that your business has paid. The Business activity statement BAS feature is designed to help you fill in your BAS.

When you register for an Australian business number ABN and GST we will automatically send you a BAS when it is time. The withholding cycle is the period of time that you have to notify and pay us amounts withheld for example monthly quarterly. If you ever need to contact the ATO youll need the Document ID and your ABN to identify your business.

BAS service is defined in the Tax Agent Services Act 2009 TASA as. A Business Activity Statement BAS is a tax reporting requirement by the Australian Taxation Office. Business Activity Statement is knowns as a form that is submitted to the Australian Taxation Office by registered business entities to report their tax obligations including GST PAYGW Pay As You Go Withholding PAYGI Pay As You Go Installments and other tax installments.

Simpler BAS reporting method. You wont need to submit tax invoices when you lodge your GST return but you will need to have them on hand. You make input-taxed supplies as your main business or enterprise activity.

The BAS is a form that all businesses submit to the Australian Taxation Office ATO to report their taxation obligations. Where it is reasonable to expect a client will rely on the service to satisfy liabilities or obligations or to claim entitlements under a BAS. This topic provides information about the Business activity statement BAS for Australia.

What you need to report. It is issued by the ATO on a monthly or quarterly basis. Representing a client in their dealings with the Commissioner of Taxation in relation to a BAS provision.

About the Simpler BAS and Full BAS reporting methods Xero provides two options for completing the Activity Statement. The GST reporting method you use is based on your businesss GST turnover and other reporting requirements. When to pay and report on activity statements Due dates for paying and reporting withheld amounts depend on whether you are a small medium or large withholder.

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

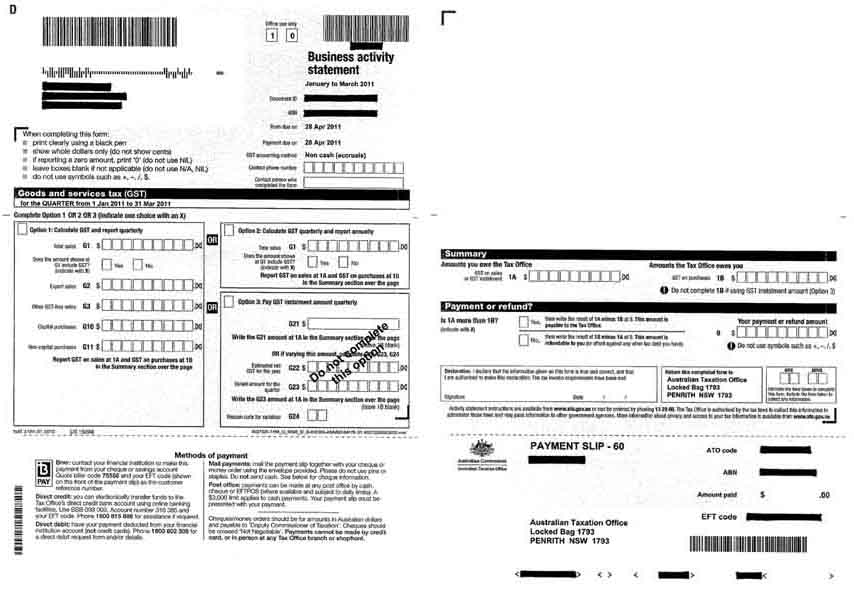

Appendix 2 Example Business Activity Statement Igt

Appendix 2 Example Business Activity Statement Igt

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

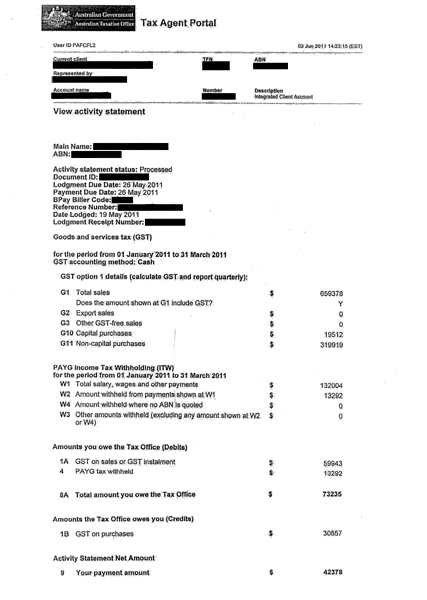

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

Business Activity Statement Bas Report Halaxy

Business Activity Statement Bas Report Halaxy

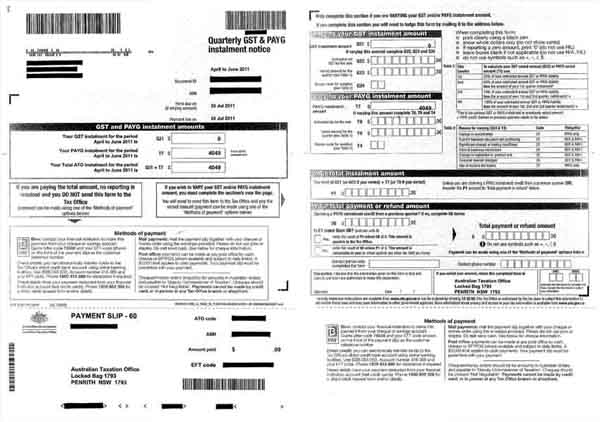

Appendix 2 Example Business Activity Statement Igt

Appendix 2 Example Business Activity Statement Igt

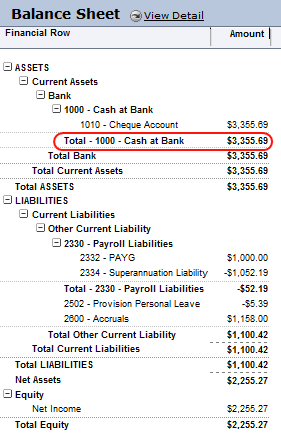

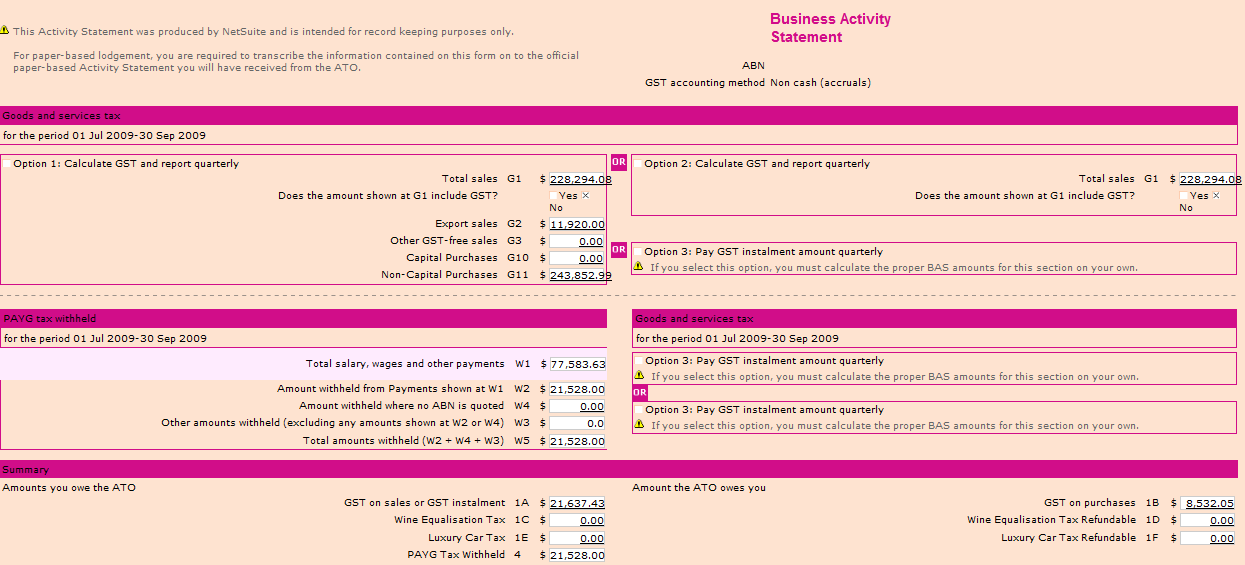

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions

Business Activity Statement Bas Return All Sorted Bookkeeping Services

Business Activity Statement Bas Return All Sorted Bookkeeping Services

Low Doc Loan With Business Activity Statements

Low Doc Loan With Business Activity Statements

Mgr Accountants Group Avoid These Common Errors On Your Bas

Mgr Accountants Group Avoid These Common Errors On Your Bas

What Is A Bas Statement Small Business Guides Reckon Au

What Is A Bas Statement Small Business Guides Reckon Au

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions

Suntax What Is A Business Activity Statement

Suntax What Is A Business Activity Statement

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

8 Business Activity Statement Templates In Pdf Doc Free Premium Templates

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions