Do I Need An Ein Number If I Am A Sole Proprietor

If youre a sole proprietor you must have an EIN to. As a sole proprietor you must apply for the NPI using your own Social Security Number SSN not an Employer Identification Number EIN even if you have an EIN.

You Have A Sole Proprietorship And Might Not Know It

You Have A Sole Proprietorship And Might Not Know It

Do I need a new USDOT number if I am changing my companys Legal Name or Form of Business.

Do i need an ein number if i am a sole proprietor. Have a Keogh or Solo 401k retirement plan. Its a nine-digit number assigned to you by the IRS for the purpose of filing taxes. For obvious reasons corporations LLCs and other business entities must use EINs.

It doesnt hurt to be proactive about obtaining an EIN. If you have an existing EIN as a sole proprietor and become a sole owner of a Limited Liability Company LLC that has employees. While an EIN is required for general partnerships corporations and multi-member LLCs sole proprietorships and single-member LLCs are required to get an EIN if they have employees.

There are situations where an EIN Employer Identification Number is legally required for a sole proprietor and situations where an EIN is recommended but not legally necessary. Sole proprietors may or may not have employees. Corporations and partnerships are required to have an EIN.

13902 31134 and 49 CFR. If your sole proprietorship needs an EIN it is a good time to research choosing between a sole proprietorship vs an LLC. A Social Security Number SSN is an acceptable Tax ID for a Sole Proprietorship.

Published 10182019 1020 AM Updated 11202019 0138 PM The FMCSAs policy is to assign a unique USDOT identification number to each person required to identify themself with FMCSA under 49 USC. However if you are a sole proprietor the IRS does not require one. A tax ID number is not required if you operate a sole proprietorship or an LLC with no employees in which case you would simply use your own Social Security Number as a tax ID.

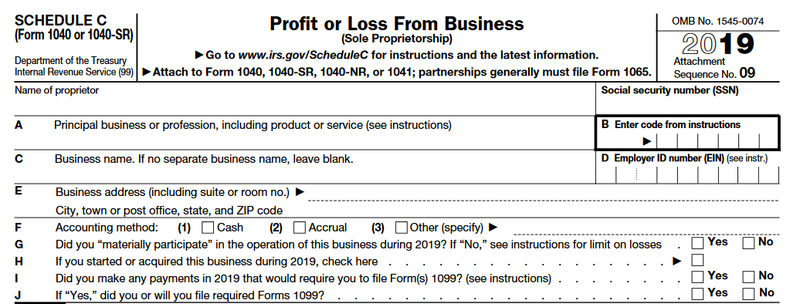

However there are instances when obtaining an Employer Identification Number EIN is required or recommended particularly if the business owner wishes to engage in certain types of business activities. However there are some times when a separate number is necessary. When you receive any Forms 1099-NEC or Forms 1099-MISC if applicable you will put them on your Schedule C as sole proprietor since there is not return being filed for the LLC at this time.

Even so you may want to obtain an EIN anyway. Sole proprietors and single owner Limited Liability Company may choose to use either their SSN or ITIN as their Tax ID Number provided they dont have employees. While there are several good reasons to apply for an EIN depending on the nature of your business it may not be entirely necessary.

Do not request another EIN as sole proprietor and use your own SSN on the W-9 it should be you because you are the owner of the single member LLC. Yes if you have an existing Sole Proprietorship with an EIN with or without a DBA and you want to change your Sole Proprietorship to an LLC you will need a new EIN from the IRS. When EIN Is Required for Sole Proprietors.

The business does not exist separately from the owner. You can operate your business and file your tax returns under Schedule C the main self-employment tax form using just your Social Security Number SSN. An EIN is your businesss federal employer identification number.

As a sole proprietor you can use your Social Security Number SSN for filing tax returns or you can obtain a new EIN and use the same. Sole proprietors on the other hand can simply use their social security number. Instead you can use your Social Security Number and report your income and expenses on a Schedule C tax form httpwwwirsgovpubirs-pdff1040scpdf.

However most sole proprietors dont need to obtain an EIN and can use their Social Security numbers instead. In this instance the sole proprietor uses his or her social security number instead of an EIN on a tax return. However at any time the sole proprietor hires an employee or needs to file an excise or pension plan tax return the sole proprietor will need an EIN for the business and cant use his or her social security number.

Otherwise you do not need to have a federal Employer Identification Number EIN assigned in order to be self-employed. Usually it is totally acceptable for a sole proprietor to use his or her social security number in the place of any other tax identification number. The sole proprietor reports business income on his or her individual tax return.

The risks of business apply to the individuals personal assets including those not used for the business. In most cases a sole proprietor does not need to get an EIN. Even though a Single-Member LLC is by default taxed like a Sole Proprietorship the IRS looks at the Sole Proprietorship and the new LLC as two different entities therefore they require that you get a new.

The Employer Identification Number is one of the most important forms of Taxpayer Identification Numbers TIN as it is mandatory for a wide variety of businesses including corporations and LLCs. But you must obtain an EIN if you are a sole proprietor who files pension or excise tax returns.

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Can A Sole Proprietor Build Business Credit Nav

Can A Sole Proprietor Build Business Credit Nav

Do You Have To Register As A Sole Proprietor

Do You Have To Register As A Sole Proprietor

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

When To Apply For An Ein As A Sole Proprietor

When To Apply For An Ein As A Sole Proprietor

Does A Sole Proprietor Need An Ein Your Freelancer Friend

Does A Sole Proprietor Need An Ein Your Freelancer Friend

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

How To Set Up A Sole Proprietorship In Virginia 14 Steps

How To Set Up A Sole Proprietorship In Virginia 14 Steps

Does A Sole Proprietor Need An Ein Your Freelancer Friend

Does A Sole Proprietor Need An Ein Your Freelancer Friend

Thinking About Starting A Sole Proprietorship Learn More Here

Thinking About Starting A Sole Proprietorship Learn More Here

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

When Does A Sole Proprietor Need An Ein Asset Protection For Real Estate Investors Royal Legal Solutions

When Does A Sole Proprietor Need An Ein Asset Protection For Real Estate Investors Royal Legal Solutions

How To Fill Out A W9 For A Sole Proprietor Legalzoom Com

How To Fill Out A W9 For A Sole Proprietor Legalzoom Com

Thinking About Starting A Sole Proprietorship Learn More Here

Thinking About Starting A Sole Proprietorship Learn More Here

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc