How To Transfer Ownership Of Sole Proprietor Business

According to LegalZoom a. To transfer full ownership of the business without lingering liabilities the original owner must close out all accounts for the business that are in.

How To Check The Minute Balance On A Tracfone Ethernet Cable Connection Wordpress

How To Check The Minute Balance On A Tracfone Ethernet Cable Connection Wordpress

Once you know what assets you are selling you need to determine a value for what.

How to transfer ownership of sole proprietor business. Separation of assets The first step in transferring ownership of a sole proprietorship is to ensure that the sole proprietor has kept their personal assets and liabilities separate from the assets and liabilities of the business. Update Operating Agreement Next you need to amend the operating agreement and. Your wife needs to be a vital part of this process as her signature is needed in various places.

In case of transfer of business on account of death of sole proprietor the transferee successor will file FORM GST ITC-02 in respect of the registration to be cancelled. Transfer of Business Ownership. In a sole proprietorship you can sell and transfer the assets of the business to a new.

First address which assets and rights the acquiring sole proprietor wants. Notify the secretary of state of the transfer of ownership if the business was operated under an assumed name or a doing business as name. 6 Steps on How to Transfer Ownership of a Sole Proprietorship 1.

Notify ACRA If you plan to transfer business ownership of the Sole-Proprietorship you must lodge the change with the Registrar online via BizFile using SingPass or CorpPass within 14 days from the date of the change. Change the Owners Names on All Documents Change the name on all documents to transfer the ownership of the business. A Basic Walkthrough Step 1.

A solo proprietorship cannot be sold or transferred in the same way that other business entities can be sold. To transfer ownership of the business one should transfer the ownership of the relevant assets. This could include filling out new IRS and state forms associated with the Tax Identification Number for your business.

Since a sole proprietorship represents the owner of the business you cannot actually transfer a sole proprietorship to someone else. Second establish how the acquiring sole proprietor will compensate you. Navigate Regulatory Waters First you need to explore the regulatory restrictions placed on the transaction.

So the proprietor has to note down the following things before transferring his. But the Internal Revenue Service allows the estate taxes of a closely held business such as a family business. Transferring ownership of a sole proprietorship involves an asset sale and closing out the original owners personal responsibility for the business.

Valuation of the Business. Thereby transferring the responsibility of running the business to a new owner. All the legal obligations and debts that youve undertaken throughout the operation of the business will remain with.

A sole proprietorships vendor and supplier operating accounts and bank and credit financial accounts are typically in the name of the owner as an individual not in the name of the business. Transferring ownership of a sole proprietorship involves an asset sale and closing out the original owners personal responsibility for the business. Step 1 Determine which assets are part of the.

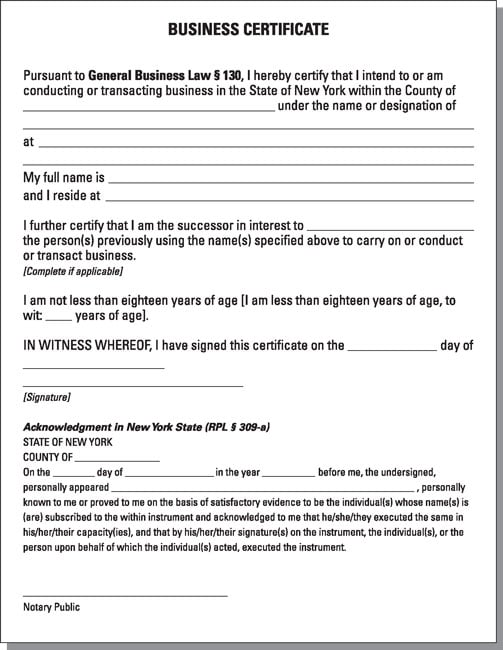

If a name other than the owners name is used most states require the proprietor to file an assumed-name certificate or similar filing. Youll also update sole proprietorship registrations including business permits licenses and trade name registrations bank accounts and contracts to reflect the change. Unlike a company theres no legal difference between a sole proprietorship and its owner.

Compensation options range from an immediate lump sum to a series of payments over time. Know What You are Selling. To convert a sole proprietorship to a limited liability company LLC youll file the same paperwork as you would if you had created the LLC from scratch.

Business assets and liabilities of a sole proprietorship are personally owned by the sole proprietor not by a separate business entity. The sole proprietor can transfer his business by selling its tangible and intangible assets. Normally the heirs of a deceased business owner would have to pay an estate tax rate of up to 40 before they can take over ownership interests in the company.

Types Of Business Ownership Powerpoint Note Taking Guide Quiz And Quiz Key Business Ownership Business Note Taking

Types Of Business Ownership Powerpoint Note Taking Guide Quiz And Quiz Key Business Ownership Business Note Taking

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal Sole Proprietorship Business Structure Sole Trader

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal Sole Proprietorship Business Structure Sole Trader

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

Transfer Of Business Ownership Agreement Template Awesome Lease Transfer Letter Template 6 Free Word Pdf Fo Contract Template Business Ownership Best Templates

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

How To Transfer Ownership Of A Sole Proprietorship Legalzoom Com

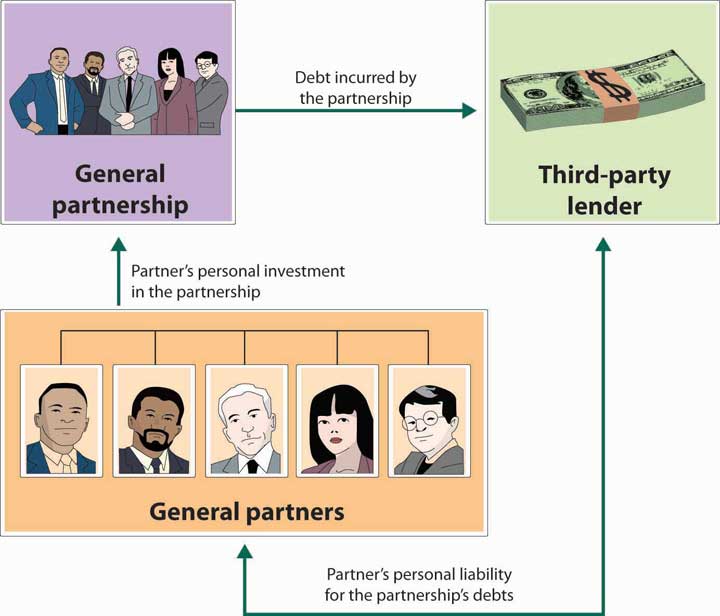

A General Partnership Is Much Like A Sole Proprietorship In That Liabilities Are Still Completely On General Partnership Sole Proprietorship Business Structure

A General Partnership Is Much Like A Sole Proprietorship In That Liabilities Are Still Completely On General Partnership Sole Proprietorship Business Structure

How To Establish A Sole Proprietorship In Texas Nolo Com Sole Proprietorship Entrepreneur Stories Critical Essay

How To Establish A Sole Proprietorship In Texas Nolo Com Sole Proprietorship Entrepreneur Stories Critical Essay

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection

How To Transfer Ownership Of A Sole Proprietorship Ethernet Cable Wordpress Connection

How Should You Incorporate Your Business Here S A Cheat Sheet Infographic Legal Business Startup Infographic Business Law

How Should You Incorporate Your Business Here S A Cheat Sheet Infographic Legal Business Startup Infographic Business Law

Sole Proprietorship And Your Import Export Business Dummies

Sole Proprietorship And Your Import Export Business Dummies

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

Forms Of Business Ownership Business Ownership Organization Development Business

Forms Of Business Ownership Business Ownership Organization Development Business

Best Ownership Transfer Letter Templates For Free Besty Templates Printable Letter Templates Contract Template Lettering

Best Ownership Transfer Letter Templates For Free Besty Templates Printable Letter Templates Contract Template Lettering

Advantages Of Business Incorporation Business Business Structure Sole Proprietorship

Advantages Of Business Incorporation Business Business Structure Sole Proprietorship

Image Result For Sole Trader Ltd Plc

Image Result For Sole Trader Ltd Plc

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings