Where Do I Send 1099 Forms In Missouri

In most cases if you participated in combined filing for your 1099s then you do not need to send 1099s to the states Department of Revenue they should already have a copy. This information must be reported each year for tax purposes.

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

For more information check our FAQs about Withholding Tax.

Where do i send 1099 forms in missouri. Plus we distribute 1099 form copies to payees via postal mail. When filing federal copies of forms 1099 with the IRS from the state of Missouri the mailing address is. Box 2200 Jefferson City MO 65105-2200.

Missouri Department of Revenue Taxation Division PO. You can download and print the form you need Copy B of 1099-MISC from the IRS website. State-Specific Guidance for Form 1099-NEC.

Your state return a copy of your federal return the 1099-R 1009-DIV and the SSA-1099. Yes Missouri does. Kansas City MO 64999 0052.

When filing state copies of forms 1099 with Missouri department of revenue the agency contact information is. You can either file 1099-NEC electronically with the IRS using the IRS FIRE system or you can mail it to your local Department of the Treasury Internal Revenue Service Center. The W-2 or 1099 data file can have any name but must have a txt extension.

Missouris version of the 1099 is the Missouri Form 99-MISC. Form 1099-G details how much unemployment benefits a claimant received during the calendar year as well as information about taxes withheld from their benefits. You will have to send paper to.

Forms 1099-MISC and 1099-NEC and their instructions such as legislation enacted after they were published go to IRSgovForm1099MISC or IRSgovForm1099NEC. Box 3330 Jefferson City Missouri 65105-3330. Please send the completed forms to the Taxation Division PO.

The Department is now providing 1099-G information online over a secure server that is available anytime. Information to our Department. The file must be submitted by January 31.

Filing Form 1099-NEC with the states may be different than you are used to though. Welcome to the Missouri Department of Revenue 1099-G inquiry service. Leave all state withholding fields blank if you do not have a WI ID.

You will need to file Form MO W-3 with Forms W-2. Some states require separate notification from the employer that they are filing 1099 forms through the CFSF Program. The IRS acts as a forwarding agent only so it is your responsibility to contact your state to verify that they have received the form and to find if they need additional information.

Missouri Department of Revenue PO. If you prefer e-filing TaxBandits is here to help you. Box 3330 Jefferson CityMissouri 651053330.

You will need to file Form MO-96 with Forms 1099-MISC. What is the 1099 filing address for Missouri. We support all 1099s with the state of Missouri.

Unlike the federal 1099 that is sent when payments reach 600 or greater the MO-99 is filed only when payments are greater than 1200. Next you must submit your 1099-MISCs to the IRS. Step 1 Visit the Missouri Department of Revenue website.

You will need to mail the following. Department of the Treasury Internal Revenue Service Center Kansas City MO 64999. Kansas City MO 64999 - 0052.

How do I file Form 1099-NEC. Form 1099-G reports the amount of refunds credits and other offsets of state income tax during the previous year. The file must follow the Social Security Administrations EFW2 format along with Missouri modifications as outlined in the Missouri Employer Reporting of W-2s Instructions and Specifications.

May 19 2020 921 PM. Louisville KY 40293-1000. Box 3330 Jefferson City MO 65105-3330.

If you want to paper file 1099 send it to the following address with 1096 and Form MO W-3. Department of the Treasury. What is the agency responsible.

It is not part of the Combined FederalState Filing Program. Jefferson City MO - Missourians who received unemployment benefits in 2019 can now view and download their 1099-G tax form online at uinteractlabormogov. Department of the Treasury.

Learn more about combined state and federal filing. The Department of Revenues 1099-G only applies to individuals who itemize their. Therefore you do not need to send a file directly to Missouri.

Sign date and mail your MO W-3 Missouri Department of Revenue Transmittal of Tax Statements along with your 1099 returns to. Missouri Department of Revenue PO. For tax year 2020 the new Form 1099-NEC will need to be reported directly to Missouri.

Youll need to either file online or order the forms you need Copy A of 1099-MISC and Form 1096. PA Department of Revenue Bureau of Individual Taxes 1099 NEC Forms PO Box 280509 Harrisburg PA 17128-0509 Wisconsin. Box 3330 Jefferson City MO 65105-3330.

Please mail it certified to your state so you can track it to make sure they receive it.

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

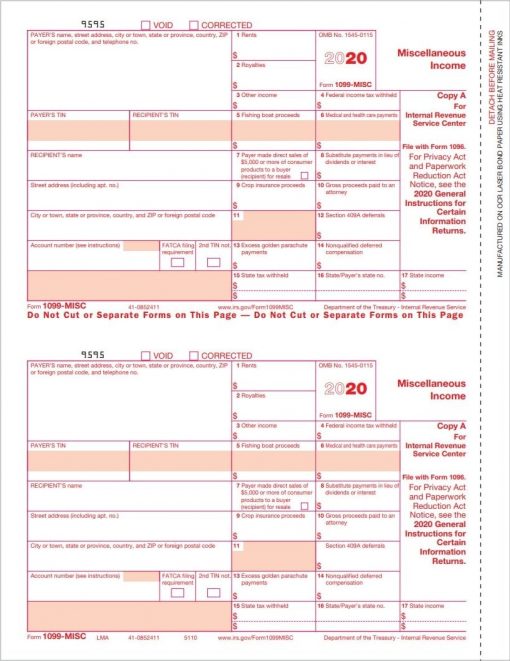

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

1099 R Form Copy D 1 Payer State Discount Tax Forms

1099 R Form Copy D 1 Payer State Discount Tax Forms

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Nec Form Copy C 2 Discount Tax Forms

1099 Nec Form Copy C 2 Discount Tax Forms

1099 S Form Copy C Filer State Discount Tax Forms

1099 S Form Copy C Filer State Discount Tax Forms

1099 Misc Form Copy B Recipient Zbp Forms

1099 Misc Form Copy B Recipient Zbp Forms

1099 S Form Copy B Transferor Discount Tax Forms

1099 S Form Copy B Transferor Discount Tax Forms

Where Do I File Form 1099 Misc With Images Online Filing Irs Online Form

Where Do I File Form 1099 Misc With Images Online Filing Irs Online Form

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms