Business Solar Tax Credit Irs Form

The investment credit consists of the rehabilitation energy qualifying advanced coal project qualifying gasification project and qualifying advanced energy project credits. Tips When Considering Solar Energy Systems.

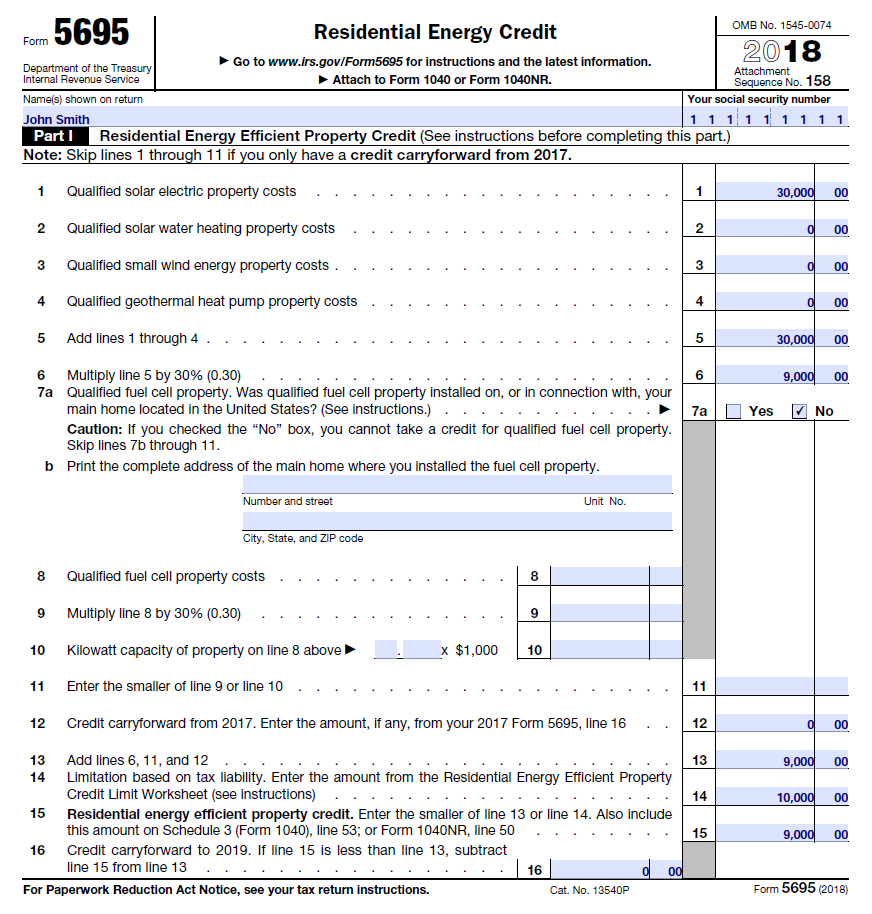

How To File The Irs Form 5695 Itc Solar Tax Credit 1876 Energy 1 Solar Energy And Solar Panel Installations In Texas California

How To File The Irs Form 5695 Itc Solar Tax Credit 1876 Energy 1 Solar Energy And Solar Panel Installations In Texas California

IRS Form 5695 Explained Claim Solar Tax Credit One of the reasons you may have gone solar for your home is the Federal Investment Tax Credit ITC commonly known as the Solar Tax Credit.

Business solar tax credit irs form. Mar 19 2021 Form 5695 Line 14 Worksheet Reducing the credit Line 14 is where it gets tricky. Complete IRS Form 5695. Make sure you have enough tax appetite to use the federal ITC against your total taxes.

Jan 07 2021 As an owner of a commercial solar system tax credit can be claimed when filing a yearly federal tax return. For the residential federal solar tax credit under some circumstances. On the dotted line to the left of line 25 enter More than one main home.

This credit raises the question as to how much of the equipment and materials are properly includible for purposes of calculating the credit. Jan 02 2021 Form 5695 instructions. There are two parts that cover the two primary tax credits for residential green upgrades.

Jan 02 2021 IRS guidance number 201809003 specifies that battery installations for which all energy that is sussed the charge the battery can be effectively assured to come from the solar energy system are eligible for the full solar tax credit. The amount on line 18 can exceed 500. Then complete the rest of this form including line 18.

Individual Income Tax Transmittal for an IRS e-file Return. You only need to fill out the parts that are relevant to you. The thing about the solar tax credit is it isnt fully refundable meaning you can only take a credit for what you would have owed in taxes.

The 3 steps to claim the solar tax credit. You need to submit it alongside Form 1040. Solar illumination and solar energy property.

You can fill out Form 3468 and then. Aug 01 2019 The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic PV system that is placed in service during the tax year1 Other types of renewable energy are also eligible for the ITC but are beyond the scope of this guidance. Taxpayers claim many of these credits using IRS Form 3468.

Jun 05 2019 You can take a 30 credit AND depreciate 85 of the cost of your solar energy panels. Credits claimed using the form In general the investment credit is available to property owners who engage in specific types of projects on their property. To take this you would have to fill out that form yourself and print and mail your return with that form attached.

Determine if you are eligible. The Federal ITC makes solar energy more affordable for homes and businesses to go solar. Purpose of Form Use Form 3468 to claim the investment credit.

When filing your taxes make sure to let your accountant know that you are implementing solar energy on your commercial property using IRS Form 3468 Investment Tax Credit. There are three broad steps youll need to take in order to benefit from the federal solar tax credit. The credit for solar illumination and solar energy property is reduced to 26 for property the construction of which begins in 2020 2021 or 2022.

48 a 2 A provides a 30 credit for solar energy equipment in commercial property if construction begins before Jan. About Form 3800 General Business Credit About Form 4255 Recapture of Investment Credit About Form 8453 US. See Line 12c later.

Some of these tax credits are being reduced to 22 for property construction beginning in 2021. Phasing out of certain investment credits. Oct 22 2020 Form 3468 is a general investment tax credit that includes several different credits.

IRS rules require that a tax credit associated with a passive investment. Form 5695 is what you need to fill out to calculate your residential energy tax credits. On line 25 of the form with the combined amount on line 24 cross out the preprinted 500 and enter 1000.

The credit for qualified fuel cell property is reduced to 26 for property the construction of which begins in 2020 2021 or 2022. If you file electronically you must send in a paper Form 8453 US. For example one arrangement is the creation of a special purpose entity where community members form and invest in a business that operates the community solar project.

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Qualifying For The Solar Tax Credit Go Solar Group

Qualifying For The Solar Tax Credit Go Solar Group

Irs Time To Move On Work Quotes Some Tax Quotations The Irs Missed Dogtrainingobedienceschool Com

Irs Time To Move On Work Quotes Some Tax Quotations The Irs Missed Dogtrainingobedienceschool Com

How To File The Irs Form 5695 Itc Solar Tax Credit 1876 Energy 1 Solar Energy And Solar Panel Installations In Texas California

How To File The Irs Form 5695 Itc Solar Tax Credit 1876 Energy 1 Solar Energy And Solar Panel Installations In Texas California

Federal Tax Credit Solar Power Archives Southern Current

Federal Tax Credit Solar Power Archives Southern Current

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

The Federal Solar Investment Tax Credit What It Is How To Claim It

The Federal Solar Investment Tax Credit What It Is How To Claim It

How To Claim The Federal Solar Investment Tax Credit Solar Sam

How To Claim The Federal Solar Investment Tax Credit Solar Sam

Federal Tax Credit Solar Power Archives Southern Current

Federal Tax Credit Solar Power Archives Southern Current

How To File The Irs Form 5695 Itc Solar Tax Credit 1876 Energy 1 Solar Energy And Solar Panel Installations In Texas California

How To File The Irs Form 5695 Itc Solar Tax Credit 1876 Energy 1 Solar Energy And Solar Panel Installations In Texas California

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

How To Claim The Solar Tax Credit Alba Solar Energy

How To Claim The Solar Tax Credit Alba Solar Energy

Form 5695 Instructions Information On Irs Form 5695

Form 5695 Instructions Information On Irs Form 5695

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

How To File The Irs Form 5695 Itc Solar Tax Credit A M Sun Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage