Does S Corp Need A 1099

You will need an EIN if you answer Yes to any of the following questions. As an S Corporation if you have utilized independent contractors it is very likely you will have form 1099 reporting requirements.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Do S corps get 1099 forms sent to them.

Does s corp need a 1099. Theres also more than one type of 1099 form so you. Generally payments to a corporation including a limited liability company LLC. Can I ammend my s corp to reflect the 1099 - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. You Need to Understand the Tax Consequences When an Owner of S Corp. If you are the person responsible for closing the.

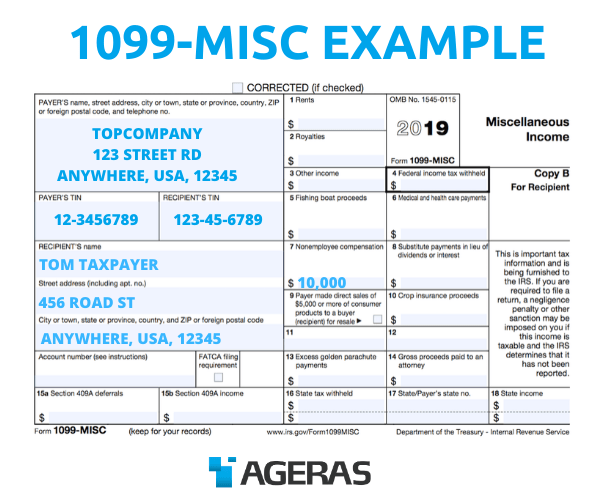

In most cases these forms do not need to be sent to corporations. This form helps the IRS know how much those self-employed contractors will pay in taxes. IRS uses form 1099MISC and 1099-NEC to track payments made to self-employed independent contractors.

Payments for which a Form 1099-MISC is not required include all of the following. Although S corporations do not owe federal income tax they must file Form 1120S with the Internal Revenue Service as an informational return. A 1099-MISC form is primarily used to report payments made to non-employees like a contractor or service provider.

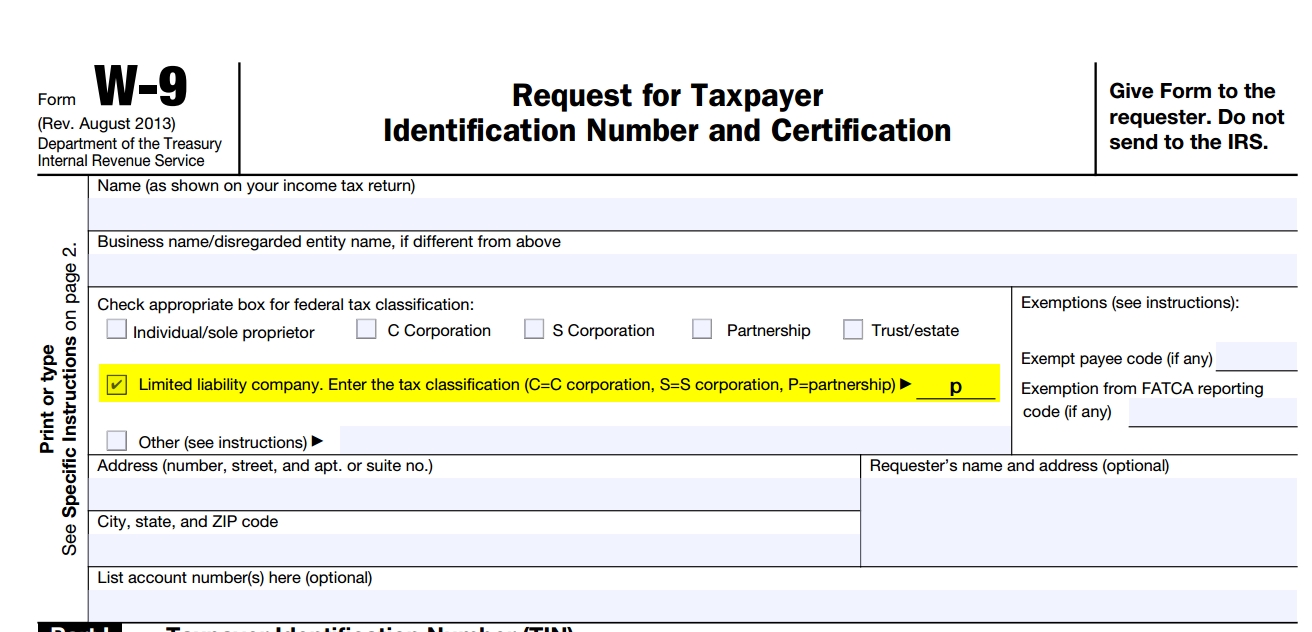

If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099. For example if you make 500000 in one year but only designate 20000 of that as salary income you might trigger an IRS. Payments for which a Form 1099-MISC is not required include all of the following.

Paying wages via 1099-MISC instead of W-2 has no tax effect. I do not believe you need to issue a F1099 to a corporation. Rather the IRS uses Form 1099-MISC to track payments made to a contractor or service provider.

If you cancel debt in excess of 600 owed to you by an S corporation you must issue a 1099-C. Daily Limitation of an Employer Identification Number. PA resident purchases goods on the Internet that are subject to PA sales tax.

Form MISC 1099s serve several purposes. Overpaying the IRS When an S Corp pays its owner a reasonable salary and there are remaining funds in the business its not a good idea to pay the owner a commission on a 1099-MISC. Do I send a 1099 to an S corp.

The examination begins by looking at 1099 contractors but be advised examiners are trained on Reasonable Compensation so a simple request on how the S Corp owner determined hisher salary escalates easily into a Reasonable Compensation challenge. If no one is responsible for closing the transaction the person required to file Form 1099-S is explained in 2 later. However you may designate the person required to file Form 1099-S in a written agreement as explained under 3 later.

The vendor selling the goods on the Internet is not registered with the PA DOR because the vendor lacks nexus in PA. However if your independent contractor has their business established as a corporation either an S Corp or a C Corp then for tax purposes they would be considered as such and would not typically be filing Form 1099s. There are situations in which S corporations receive 1099s other than Form 1099-MISC.

Additionally the corporation must complete a Schedule. No corporations S Corps and C Corps are exempted from requiring a 1099-MISC therefore you do not normally have to send this form to any corporations including an S Corporation. This is the same for both C and S corporations.

The 1099 allows the independent contractors to properly account for and report their income as well as the businesses they contract with to measure their contractor expenses. Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. If youve asked yourself this question its important to understand that you do not send 1099 forms to corporations.

Improperly Receives a 1099-MISC Fact Pattern. The IRS tends to take a closer look at S-corporation returns since the potential for abuse is so large. Need to add 1099nec to my business taxes that has been filed.

Contractors doing business as a Limited Liability Company LLC should have. An S-Corp is a corporation. For your convenience clicking on the Yes option will take you directly to How to apply for an EIN.

Generally payments to a corporation. Now back to the original argument. The IRS through this can figure out how much taxes will be paid by those self-employed individuals or partnerships.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Do You Need To Issue A 1099 To Your Vendors

Do You Need To Issue A 1099 To Your Vendors

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

What Is A C Corporation What You Need To Know About C Corps Gusto

What Is A C Corporation What You Need To Know About C Corps Gusto

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Is Form 1099 Nec For Non Employee Compensation

What Is Form 1099 Nec For Non Employee Compensation

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

How To Read Your 1099 Justworks Help Center

How To Read Your 1099 Justworks Help Center