How To Get Doordash 1099 Tax Form

Typically you will receive your 1099 form before January 31 2021. As a general rule if you make more than 600 in a calendar year Postmates will usually send you a Form 1099.

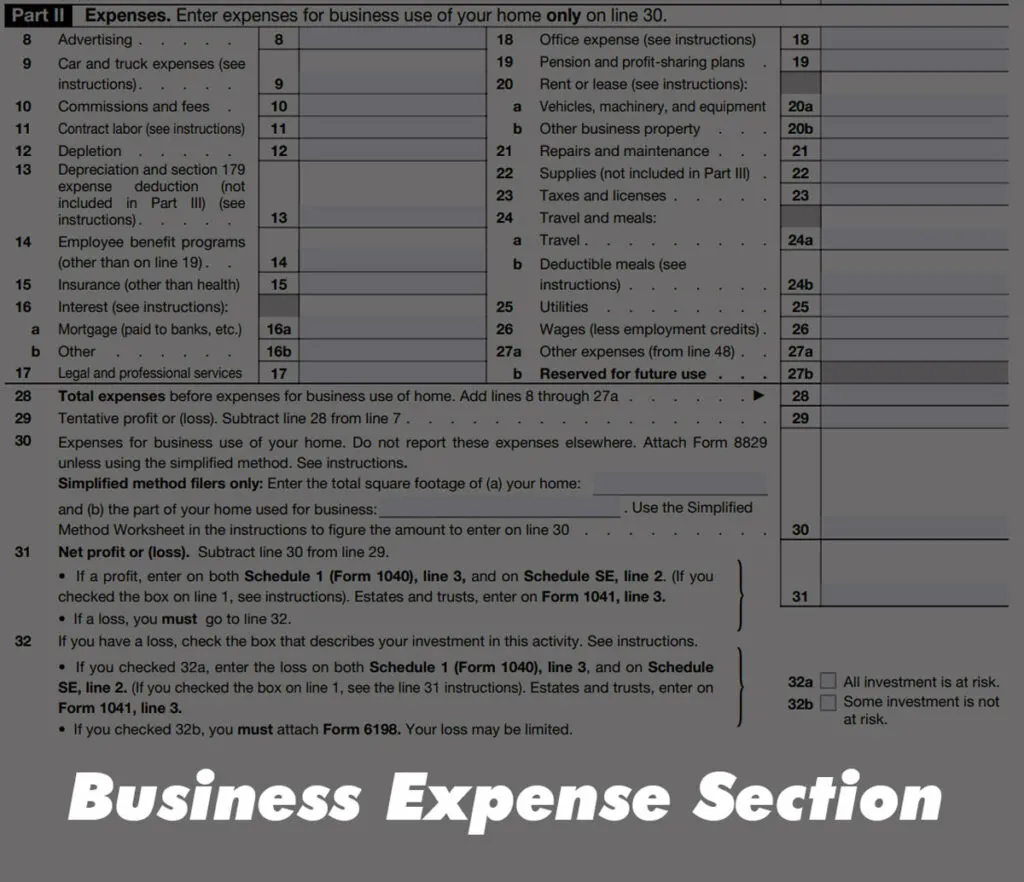

It will look like this.

How to get doordash 1099 tax form. All these tax programs do with your 1099 forms that you enter is. How to AddEdit Vehicle Information. The secure link will expire 24 hours after sending.

If youve received a form from Doordash that means according to their records youve earned over 600 from them. Form 1099-NEC reports income you received directly from DoorDash ex. Can They Deliver This Form Another Way.

You can also access your account by tapping on your profile picture in. If you make less than 600 a year you wont receive a 1099 from them but you will still have to report the gross amount to the IRS. Youll only get a 1099-MISC form after earning more than 600 with a company.

I did doordash and I know that I needed to make 60000 or more to get a 1099 form. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. None of your 1099 information like the company their EIN any of that gets moved to your tax forms.

My Account Tools Topic Search Type 1099misc Go Enter your 1099misc and follow the prompts. If you try accessing the link after it expires you will automatically be sent a new link. How do I get more orders and make more money.

If you are a full time dasher you may have to wait for Payable to send you a 1099-K instead of a 1099-NEC. It may take 2-3 weeks for your tax documents to arrive by mail. This form stands for Payment Card and Third Party Network Transactions meaning that Payable will send you the 1099-K since they settle the transactions of your DoorDash.

Doordash may not sent out a 1099 for you if you received less than 600 from them. All tax documents are mailed on or before January 31 to the business address on file with DoorDash. Doordash can be reach via phone at 855-973-1040 or through their support team here.

Where are my earnings reported on the form. Doordash will send you a 1099-NEC form to report income you made working with the company. View All 14 Sign-up Questions.

The DoorDash income Form 1099misc is considered self employment income. You will have to file a 1099-K instead of a 1099-NEC if you make more than 20000 in sales and have 200 or more transactions. The IRS requires them to send out their 1099s by January 31st.

Per requirements set by the IRS only restaurant partners who earned more than 20000 in sales and did 200 transactions deliveries or more during the previous year are provided a 1099 form. All Dashers need to accept the invite from DoorDash 2018 in order to access their 2018 1099-MISC form. Launch the Payable app and log in to your account.

Multi-million or multi-billion dollar company needs to fix what is broken. Form 1099-NEC is new. You can also access your account by tapping your profile picture in the.

How can I get new Dasher accessories. You do not have to use. If you had a Payable account for a previous year please register a new email in order to access your 2018 1099-MISC form.

But my thing is is that my - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. How do I refer other Dashers. Review DoorDashs tax FAQ or the company email for more information about Payable.

The most important box on this form that youll need to use is Box 7 Nonemployee Compensation. The income as well as expenses including your vehicle can be entered by following the information below. Companies are required to have sent out their 1099-NEC forms by mail or electronically by January 31st of each year or February 1st if the 31st is on a Sunday such as in 2021.

If you do not receive your 1099 contact DoorDash customer support. None of it gets sent in. If you select e-delivery as the preferred method to receive your 1099-NEC form youll receive an email from Stripe with a secure link where you can download your 1099.

Non-employee compensation includes relevant information for your taxes. By default DoorDash will mail your tax form to the address associated with your Dasher account unless you specify otherwise. These items can be reported on Schedule C.

About the Dasher Activation Kit. How can I check the status of my Background Check. Theres a menu on the left pull it out and tap on My Account at the bottom.

View All 10 Using The Dasher App. On your 1099-MISC this is what it will look like. Tax Form 1099-NEC vs 1099-K.

Incentive payments and driver referral payments. Can they complete this form in another way. Scroll down to find the Verification and Tax.

The IRS doesnt want you to send a copy of your 1099. Start the Payable app and log in to your account. There is a menu on the left pull it out and tap My Account at the bottom.

How To File Taxes For Free In 2021

Doordash 1099 Taxes And Write Offs Stride Blog Doordash Tax Write Offs Tax Help

Doordash 1099 Taxes And Write Offs Stride Blog Doordash Tax Write Offs Tax Help

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

Understanding Your Instacart 1099

Understanding Your Instacart 1099

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

Pin By Neona Burton On Shmoney Doordash Instacart Tax

Pin By Neona Burton On Shmoney Doordash Instacart Tax

Doordash Taxes Made Easy A Complete Guide For Dashers

Doordash Taxes Made Easy A Complete Guide For Dashers

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

Side Hustle Idea List In 2020 Best Credit Repair Companies Good Credit Credit Repair

Side Hustle Idea List In 2020 Best Credit Repair Companies Good Credit Credit Repair

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Massachusetts Joins Fight In Classifying Drivers As Employees Rideshare Driver Rideshare Lyft Driver

Massachusetts Joins Fight In Classifying Drivers As Employees Rideshare Driver Rideshare Lyft Driver

4 Signs You Re About To Be Hit With A Big Tax Surprise Wgn Tv

4 Signs You Re About To Be Hit With A Big Tax Surprise Wgn Tv

Doordash 1099 Taxes And Write Offs Stride Blog Doordash Tax Write Offs Tax Help

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Tax Q A With A Cpa 2019 For Doordashers And Other 1099s Youtube

Tax Q A With A Cpa 2019 For Doordashers And Other 1099s Youtube