How To Make A 1099 Form For Someone

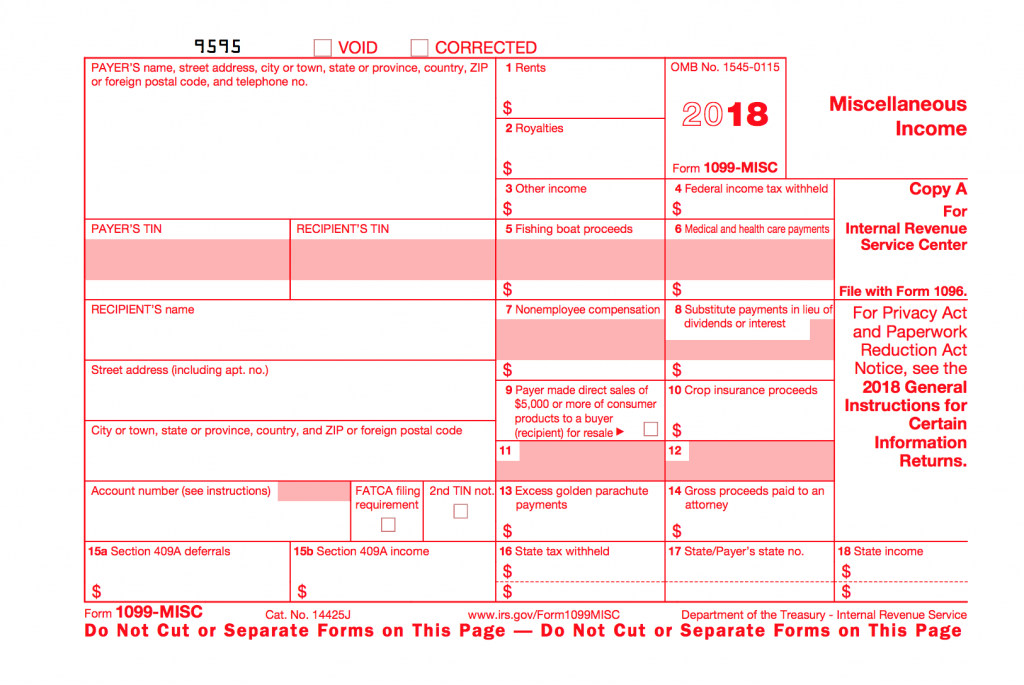

Report other information as per original return. Before the 2020 tax year Free Fillable 1099-Misc Form Box 7 is used for reporting non-employee payments.

Payer made direct sales of 5000 or more checkbox in box 7.

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

How to make a 1099 form for someone. The 1099-MISC Form generally includes. The amount of income paid to you during the year in the appropriate box based on the type of income you received 4. For example if you got paid as a freelancer or contractor the person you worked for is required to keep track of these payments and give you a 1099-NEC form showing the total you received during the year.

If the business was established newly and doesnt have an idea about Printable 1099-Misc Forms then IRS provides a one-month extension to file the Form 1099-Misc. Use our 1099 Form generator to create and customize your 1099-MISC Form document. You will just enter a description along with the total the amount paid.

Step 3 - Fill Out the. How to file a 1099 form There are two copies of Form 1099. A freelancers favorite easy online tool.

Copy A and Copy B. You do not need to enter them individually. 247 Customer Support 1.

Changes in the reporting of income and the forms box numbers are listed below. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income. Information Returns which is similar to a cover letter for your Forms 1099-NEC.

You probably received a 1099-NEC form because you worked for someone during the past year but not as an employee. The separate instructions for filersissuers for Form 1099-NEC are available in the 2020 Instructions for Forms 1099-MISC and 1099-NEC. A freelancers favorite easy online tool.

Make sure you have the current name address and social security numbers on file for. Form 1099-NEC Nonemployee Compensation is transmitted with Form 1096 Annual Summary and Transmittal of US. Prepare a new transmittal Form 1096.

How To 1099 Someone. Crop insurance proceeds are reported in. Your name address and taxpayer ID number 2.

The independent contractor and company negotiate a rate for work and services which is often part of short-term projects. This scheme usually involves the filing of a Form 1099-MISC Miscellaneous Income andor bogus financial instruments such as bonds bonded promissory notes or worthless checks. Form 1098 1099 5498 or W2G.

File Form 1099-MISC for each person to whom you have paid during the year. The IRS cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt. You have to either order them from the IRS or pick them up at an.

The name address and taxpayer ID number of the company or individual who issued the form 3. You must report the same information on Copy B and send it to the contractor. Where to enter 1099-misc YOU paid out to someone from your self-employed type business.

You need one 1099-MISC form for every independent contractor you paid that year. You will enter it as Contractor Labor in the Business Expenses section. At least 600 in.

Create your form 1099-MISC now httpsbitly35mKNzVHow to create a form 1099-MISC instantly online - No software neededSubscribe for more tutorials and h. If you hire an independent contractor you must report what you pay them on Copy A and submit it to the IRS. Step 2 - Grab Your Forms.

Prepare a new information return. Use our 1099 Form generator to create and customize your 1099-MISC Form document. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

Enter an X I the CORRECTED box and date optional at the top of the form. Correct any recipient information such as money amounts and address. Write your business name business tax ID number the contractors name and contractors tax ID number--likely her Social Security number--on the 1099 Form.

You cannot download these. The term 1099 refers to the type of tax form that a person with this working relationship receives from the various companies that hire him or her. Step 1 - Check Your Information.

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition