Is 1099 R Income Taxable In Pennsylvania

Report Pennsylvania-taxable compensation and any Pennsylvania tax withheld from that income. This distribution is taxable for PA purposes unless.

Arizona 1099 Tax Form Vincegray2014

Arizona 1099 Tax Form Vincegray2014

The instructions for.

Is 1099 r income taxable in pennsylvania. If the code was a 1 or 2 this would indicate an early distribution. Monthly retirement benefit payments from PSERS are exempt from Pennsylvania state and local. The code entered in box 7 of the 1099-R will determine the taxability on the PA return.

Compensation for Pennsylvania personal income tax purposes. The plan does not permit distributions until termination of employment except for disability or the return of employee previously tax contributions. What needs to be reported as taxable income on my PA return from the 1099-DIV.

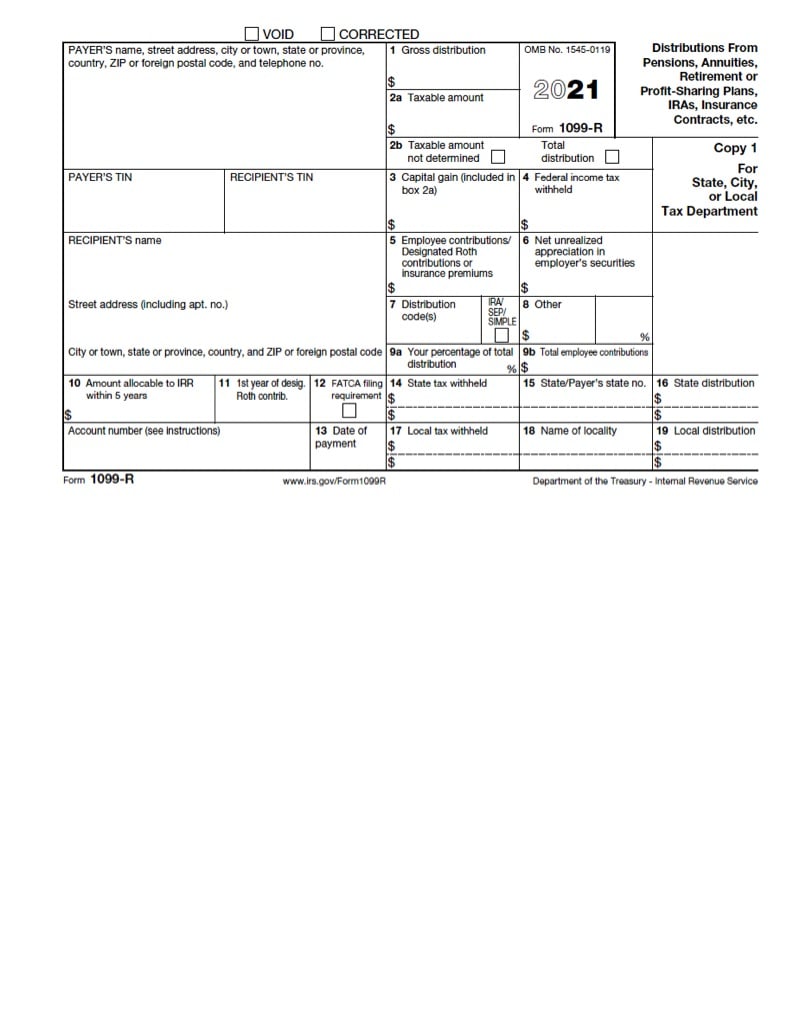

Form 1099-R Filing. 1099 r with code 6 for 31000 with contributions of 15000 gain of 16000. Pennsylvania - Retirement Income In Pennsylvania if the distribution code on the 1099-R shows as 7 for normal distribution then the distribution amount will not transfer to the PA-40 form or be included in gross income on the state return.

If it coded 1 or 2 it may be taxable to the extent that the distributions exceed your basis in your retirement plan. If the 1099-DIV is from a mutual fund blocks 1a and 2a - Total Ordinary Dividends and Total Capital Gain Distribution should be added together and reported on Schedule B and PA. How do I receive additional copies of Form 1099-R.

Pennsylvania does not tax income reported on a 1099-R from an eligible retirement plan. The Federal Codes contained in box 7 of Form 1099R include. There are situations in which some or all retirement income should be taxed in PA.

1 your pension or retirement plan was an eligible plan for PA PIT purposes and 2 you retired after meeting the age conditions of the plan or years of service conditions of the plan. If coded 1D or 7D it is a commercial annuity and is taxable same as federal. What is the poorest city in PA.

If you live in PA your SERS pension payments are exempt from PA state and local income taxes. Special notes for those who. Income Items Taxable as Pennsylvania Compensation Based on Facts and Circumstances on the following pages for descriptions of these items illustrates what items may be taxable based on the facts and circumstances of the item for Pennsylvania personal income tax purposes.

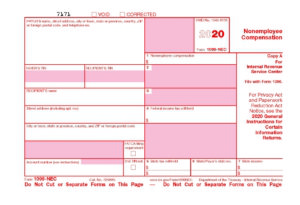

Quality service to taxpayers is our goal. How to report amounts from Form W-2 Form 1099-R Form 1099-MISC and Form 1099-NEC as well as other types of compensation not reported to the taxpayer on these documents. Keep it for your records.

No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. Do not also send in federal Form 1099-R. Exempt from PA state and local income taxes.

It is impor - tant to check your work for accuracy. Generally if box 7 of your 1099R is coded 7 or 4 it is not taxable for PA income tax purposes. This may delay processing of your return.

If you live outside of Pennsylvania you should contact the tax bureau where you live for pension distribution tax rules in your state. There is a new block 1b - Qualified Dividends. You can only access the PA Personal Income.

You will want to verify the code in box 7 of your paper 1099-R matches that which was entered into the program. Taxpayers should use block 1a - Total Ordinary Dividends. Include Pennsylvania-taxable amounts from federal Form 1099 that show pensions retirement plan distributions executor fees jury duty pay and other miscellaneous compensation.

Code 1 2 Early distribution. If your plan was not an eligible plan or if you have not attained the age or years of service required under the plan to retire you must determine the PA taxable. That explains Pennsylvanias income tax and many of its differences from federal tax rules.

How is 1099R Income to be reported on PA State Returns. Form 1099-DIV changed beginning 2003. As such we do not provide 1099-Rforms to any state or local tax authority.

1099-R 1099-MISC 1099-NEC and any other documents reporting compensation must be included with the tax return. Ing PA personal income tax returns. This block should be ignored when filing a PA tax return.

Is any of this taxable to PAIf so how do I report it. Detailed Explanation To assist you PSERS will include an explanation of the information appearing in each box on the 1099-Rs PDF.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Arizona 1099 Tax Form Vincegray2014

Arizona 1099 Tax Form Vincegray2014

How To Read Your 1099 R Colorado Pera

How To Read Your 1099 R Colorado Pera

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099 Tax Relief Instant Tax Solutions

1099 Tax Relief Instant Tax Solutions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

1099 Tax Filing Software Vincegray2014

1099 Tax Filing Software Vincegray2014

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition