What Is A 1099 Int From Mortgage Company

A 1099-INT tax form is a record that a person or entity paid you interest during the tax year. The 1099-INT reports interest paid TO you which increases your taxable income and can increase your tax bill.

What Is A 1099 Form Everything You Need To Know About This Tax Document Student Loan Hero

What Is A 1099 Form Everything You Need To Know About This Tax Document Student Loan Hero

The form is issued by all payers of interest income to investors at year-end.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

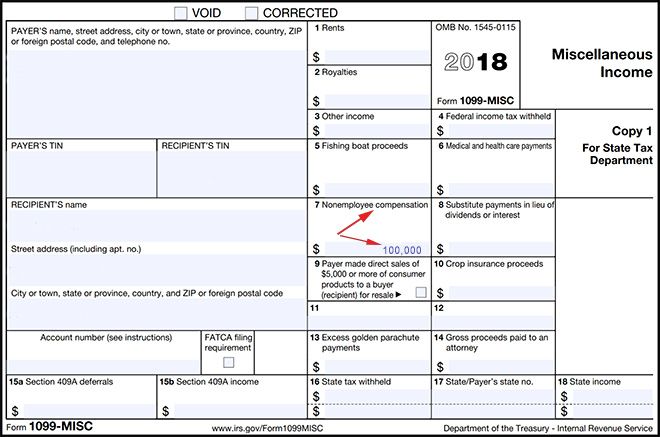

What is a 1099 int from mortgage company. The Internal Revenue Service requires most payments of interest income to be reported on tax form 1099-INT by the person or entity that makes the payments. Treasury Bills and discount commercial paper are typical. A 1099 form is a tax document filed by an organization or individual that paid you during the tax year.

All kinds of people can get a 1099 form for different reasons. Yes if you received a 1099-INT enter it as interest earned just as if it came from a bank. This is most commonly a bank other financial institution or government agency.

Form 1099-INT is. Payers should issue a 1099-INT for any party to whom they paid 10 of attention. The software may be asking if the form is from a mortgage company because some people get confused and start to enter mortgage interest PAID reported on 1098 in the interest earned section.

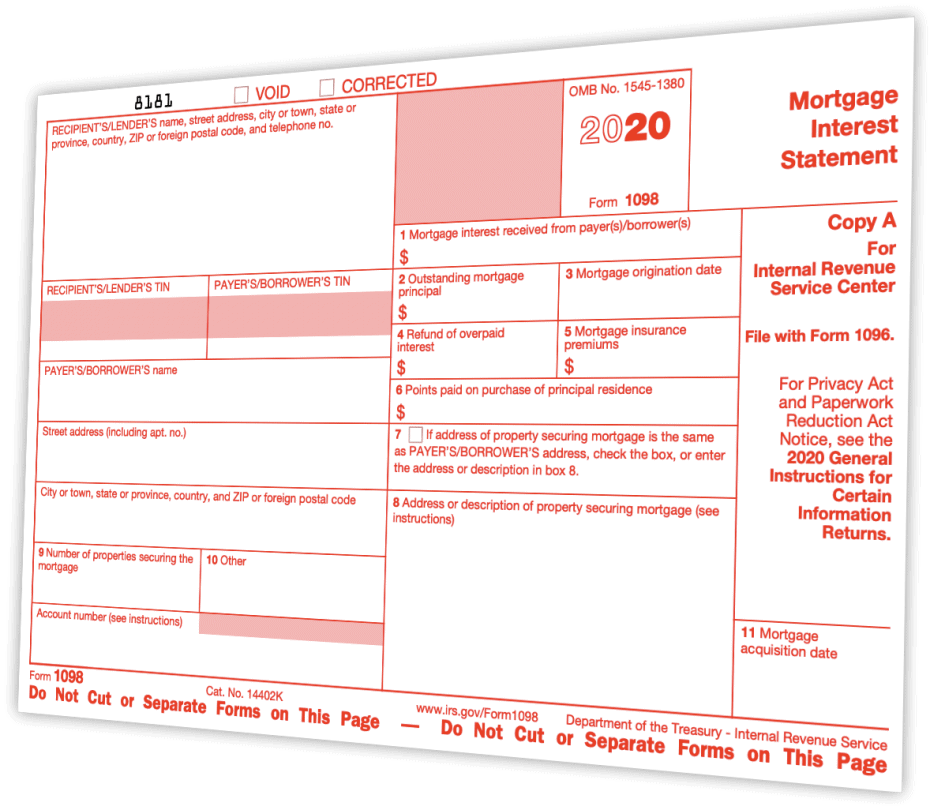

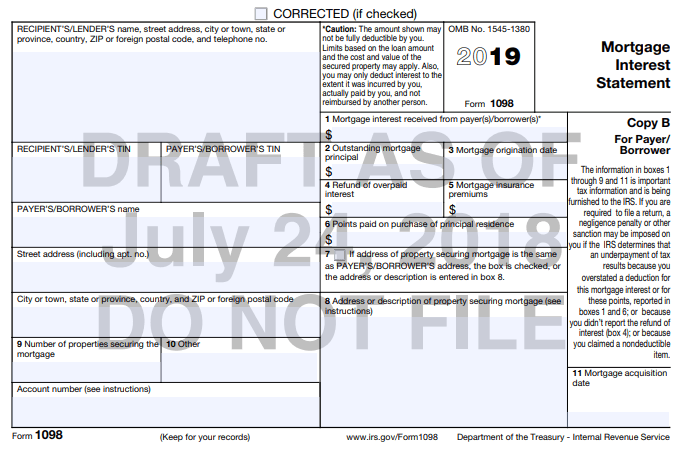

Sometime in February you might receive a 1099-INT. Form 1098 is an IRS form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals 600 or more. It features a breakdown of all kinds of expenses and interest income.

It includes a breakdown of all types of interest. Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file. Form 1098 reports money you paid to someone else while Form 1099 accounts for non-wage payments you received.

A 2009 1099 from your mortgage company shows how much interest points you paid to them for 2008 as well as the taxes you paid on your home if that is also included in your mortgage. These forms help you keep track of taxable income and possible deductions. You pay interest to your mortgage lender who.

The 1099-INT form is used to report interest income. Use Form 1098 to report mortgage interest of 600 or more received by you from an individual including a sole proprietor. A 1099 form is a record of income.

1099-INT from mortgage company Non-investing personal finance issues including insurance credit real estate taxes employment and legal issues such as trusts and wills 5 posts Page 1 of 1. Then they send me my 2005 1099-INT with only 11 months of interest. I made 5 mortgage payments in 2004.

Its from a mortgage company the money went back into escrow account. You may use Form 1099-INT rather than Form 1099-OID to report interest for an instrument issued with OID if no OID is includible in the regular interest holders or CDO holders income for the year. Form 1099-INT is the IRS tax form used to report interest income.

If the interest is from your bank the interest income for the year may also be on your December andor January bank statement. This is the equivalent of a. Even though you didnt actually receive the interest it will be used on your behalf to pay real-estate taxes or insurance.

The interview questions may be confusing in this situation. They sent me a 1099-INT for 2004 with the interest amount for the 4 payments for 2004 which seemed right to me so I filed that on my return with no problems last year. You are not required to file or issue Form 1099-OID.

All donors of interest issue the form to investors annually. Do I put that in the 1099-int section. IRS Forms 1098 and 1099 are used when filling out your tax return.

The payment for January 2005 was made on 123104. Yes put that in the interest income screen. For any interest income of 10 or more that you received in 2006 youll get a Form 1099-INT.

Short-Term Debt IssuesForm 1099-INT reports the original issue discount OID on short-term debt issues with a maturity date of one year or less from the issue date. If an individual bank or other entity pays you at least 10 of interest during a calendar year that entity is required to issue a 1099-INT to you. For example freelancers and independent contractors often get a.

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

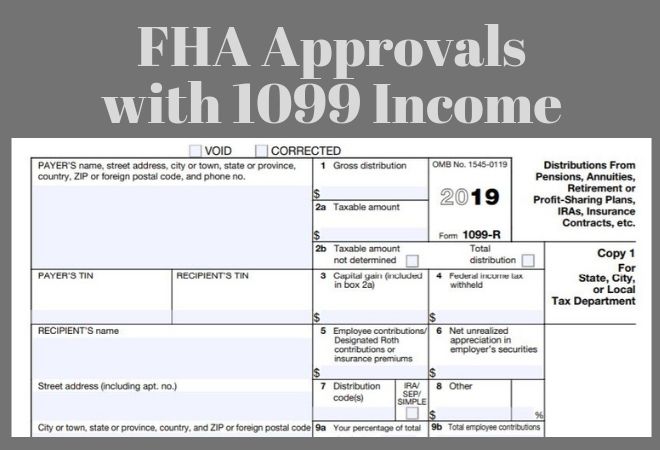

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

1098 Vs 1099 Forms Explained Difference Between These Tax Forms The Turbotax Blog

1098 Vs 1099 Forms Explained Difference Between These Tax Forms The Turbotax Blog

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Https Www Irs Gov Pub Irs Pdf I1099int Pdf

Https Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 2019 Composite Form 1099 Guide Pdf

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What The Heck Is Irs Form 1098 And Why Does It Matter Retipster

What The Heck Is Irs Form 1098 And Why Does It Matter Retipster

/ScreenShot2021-02-09at12.51.04PM-6f772fddc89f4ef9a4fdb81e432d57d8.png) Form 8396 Mortgage Interest Credit Definition

Form 8396 Mortgage Interest Credit Definition

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1098 Software To Create Print And E File Irs Form 1098 Mobile Credit Card Software Tax Forms

1098 Software To Create Print And E File Irs Form 1098 Mobile Credit Card Software Tax Forms

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Mortgage Interest Statement Form 1098 What Is It Do You Need It

/Form1098-5c57730f46e0fb00013a2bee.jpg) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg) Form 1099 C Cancellation Of Debt Definition

Form 1099 C Cancellation Of Debt Definition

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Mortgage Interest Statement Form 1098 What Is It Do You Need It

1099 Contractor Home Loan Self Employed No Tax Returns

1099 Contractor Home Loan Self Employed No Tax Returns

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Expected Changes To 1098 Mortgage Interest Statement

Expected Changes To 1098 Mortgage Interest Statement

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition