How To File Itr 4 For Small Business

For the other business if your tax liability exceeds Rs. The first step for filing ITR 4 online is to download the form from the official website of the Income Tax department.

How To File Income Tax Return Itr 4 Ay 2020 21businessman Itr 4 Fy 2019 20 Ay 2020 21 Live Filing Youtube

How To File Income Tax Return Itr 4 Ay 2020 21businessman Itr 4 Fy 2019 20 Ay 2020 21 Live Filing Youtube

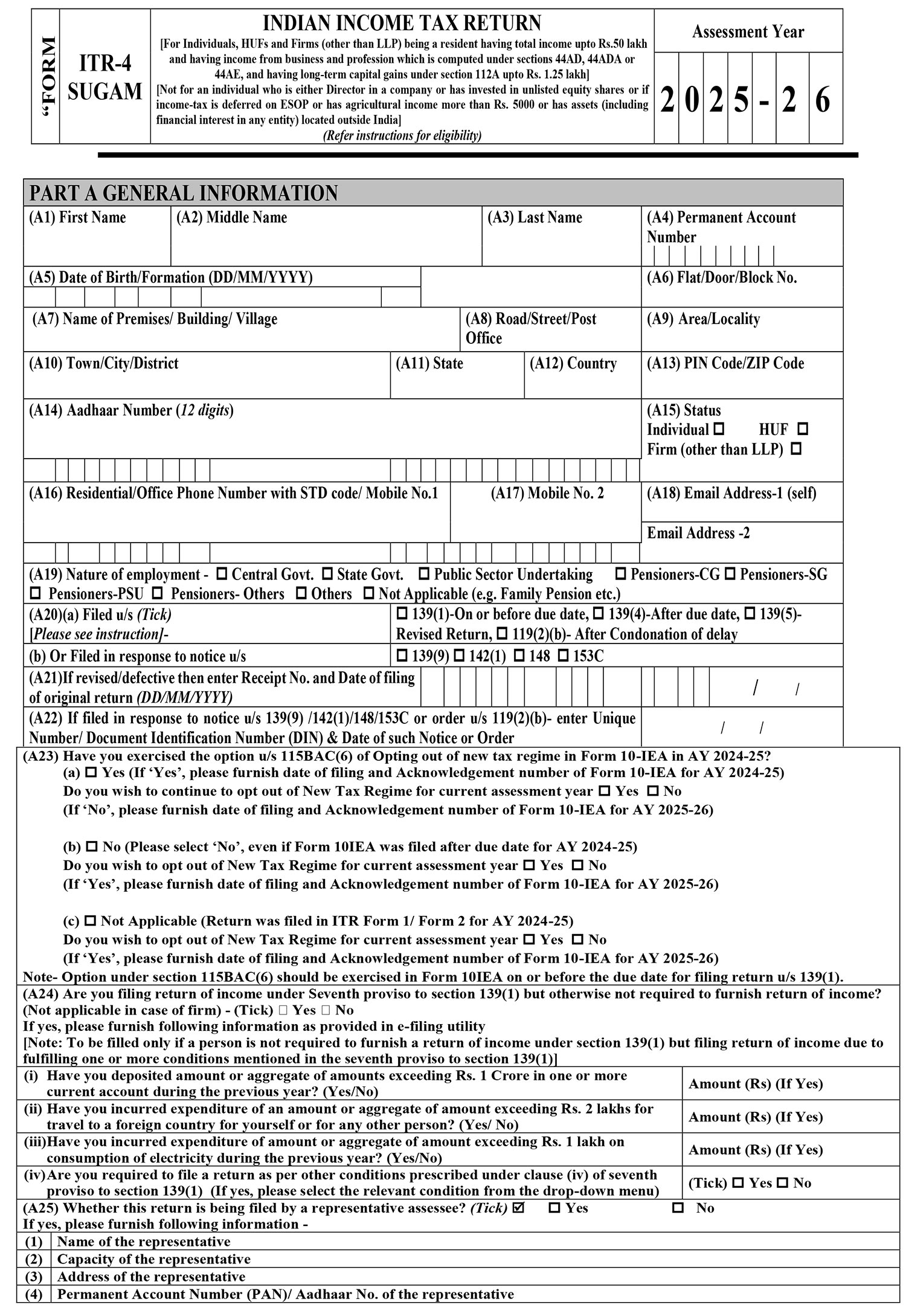

This ITR 4 is applicable.

How to file itr 4 for small business. The utility shall generate an XML file which you will be. You have to file ITR 4 form by showing both businesses income. You can register your business for free at the Connect App by ZipLoan to build your business network.

ITR filing FY 2020-21 ITR filing FY 2020-21. You can also submit using Upload XML option. If you are filing ITR 4 no need to fill entire balance sheet you just need to fill the mandatory details and that also requires only the details relating to your business.

The IT department will issue an acknowledgment when you will submit physical paper ITR 4 form. However be aware that not all entity types may apply online. Businesses need to use Sugam ITR-4 for Income Tax return if they have opted for the presumptive income scheme as per section 44AD and Section 44AE of the Income Tax Act.

5 Select Submission Mode as prepare and submit online. XML can be generated using the offline Excel or Java utilities. Procedure to file Form ITR 4.

If you are using Form ITR 3 for filing tax returns then the filing process might get a little complicated. While the main format for filing the form is online through the progress of technology users have the option of filling the form offline also if they wish to do so. Self-employed people can file tax returns in Form ITR 3 or ITR 4.

We got your back. 4 Select ITR form Name as ITR-4 Select Filing Type as applicable. Download ITR 4 from E filing website.

SUGAM form is not mandatory Form ITR-4 Sugam is a simplified return form to be used by an assessee at his option if he is eligible to declare profits and gains from business and profession on presumptive basis under section 44AD 44ADA or 44AE. By providing the return in a hard copy physical paper form. If you are having just business and salary income and if you are opting for ITR 3 then there are chances you are getting your accounts audited and in that case your CA would guide you with same.

Form SS-4 Employer Identification Number EIN Online Application If youve determined that you need an EIN you can use the online EIN application to submit your information. Now fill ITR 1 and ITR 4 using single offline JSON Utility. Check what it means for salaried class.

Select the schedules applicable to you. You have to first download the Java or Excel utility from httpsincometaxindiaefilinggovin. To fill the form online taxpayers have to follow the following method.

How to file ITR-4 Online. However in case the assessee. Struggling to file ITR for your small business.

Fill in the General details like NamePANDob etc. For AY 2021-22 the ITR 1 to ITR 4 can be filled using single JSON Utility while mport of Prefill file is mandatory in utility. The Form is freely available for download.

By furnishing the return electronically under digital signature. Employment Taxes for Small Businesses A wealth of information for your employment tax filing needs. The ITR 4 form roughly takes 5-10 minutes to declare your income.

ITR 4 is for taxpayers who opt for the presumptive taxation scheme. Utilities can be downloaded in the e-Filing portal under Downloads Offline Utilities Income Tax Return preparation utilities. How to file the ITR Form 4.

In our above example exemption from payment of advance tax is granted to the business for which presumptive scheme has been opted. 10000 in a year you are required to pay advance tax on such income.

Imgur Com Informative Filing Taxes 6th Form

Imgur Com Informative Filing Taxes 6th Form

Filing Of Income Of Tax Returns Of All Types Of Assessees Tax Preparation Tax Consulting Small Business Consulting

Filing Of Income Of Tax Returns Of All Types Of Assessees Tax Preparation Tax Consulting Small Business Consulting

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Itr 4 Form For Ay 2020 21 How To File Itr 4 Small Business Itr Auto Taxi Driver Income Tax Youtube

Itr 4 Form For Ay 2020 21 How To File Itr 4 Small Business Itr Auto Taxi Driver Income Tax Youtube

Find The Different Way To Filing Itr Income Tax Return Income Tax Tax Return

Find The Different Way To Filing Itr Income Tax Return Income Tax Tax Return

How To File Income Tax Return Itr 4 Ay 2020 21 For Business Professional Online Itr 4 Filing Youtube

How To File Income Tax Return Itr 4 Ay 2020 21 For Business Professional Online Itr 4 Filing Youtube

How To File Income Tax Return Itr 4 Ay 2019 20 For Small Businessman In Hindi Youtube

How To File Income Tax Return Itr 4 Ay 2019 20 For Small Businessman In Hindi Youtube

How To File Itr 4 For Ay 2020 21 Complete Guide Step By Step Procedure Businessman Professionals Youtube

How To File Itr 4 For Ay 2020 21 Complete Guide Step By Step Procedure Businessman Professionals Youtube

Step By Step Guide To File Itr 5 Form Income Tax Return Filing Taxes Tax Return

Step By Step Guide To File Itr 5 Form Income Tax Return Filing Taxes Tax Return

Faceless E Assessment Scheme For Taxpayers Challenges And Impact On The Indian Tax Administration In 2020 Business Tax Deductions Income Tax Return Small Business Tax

Faceless E Assessment Scheme For Taxpayers Challenges And Impact On The Indian Tax Administration In 2020 Business Tax Deductions Income Tax Return Small Business Tax

How To File Income Tax Return Itr 4 A Y 2019 20 For Professional Youtube

How To File Income Tax Return Itr 4 A Y 2019 20 For Professional Youtube

Tax Preparation Tax Saving Investment Tax Preparation Income Tax Return

Tax Preparation Tax Saving Investment Tax Preparation Income Tax Return

How To File Income Tax Return Itr 4 A Y 2018 19 For Small Businessman In Hindi Youtube

How To File Income Tax Return Itr 4 A Y 2018 19 For Small Businessman In Hindi Youtube

How To File Income Tax Return Itr 4 A Y 2019 20 For Small Businessman Itr 4 Ay 2019 20 Online Youtube

How To File Income Tax Return Itr 4 A Y 2019 20 For Small Businessman Itr 4 Ay 2019 20 Online Youtube

How File Business Itr Through Computax Itr 4 U S 44ad With Balance Sheet Income Tax Return Itr Youtube

How File Business Itr Through Computax Itr 4 U S 44ad With Balance Sheet Income Tax Return Itr Youtube

How To E File Itr 4 Sugam For Ay 2020 21 Youtube

How To E File Itr 4 Sugam For Ay 2020 21 Youtube

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Income Tax Is A Type Of Direct Tax Imposed On The Income Of The Individual Firm Or Organization Of Indian Citizen Her Income Tax Return Income Tax Tax Return

Income Tax Is A Type Of Direct Tax Imposed On The Income Of The Individual Firm Or Organization Of Indian Citizen Her Income Tax Return Income Tax Tax Return