How To Generate 1099 Forms In Quickbooks Online

Although you can sign up to our E-file service standalone website. Enter your billing info then select Approve.

From the RowsColumns drop-down menu select Change.

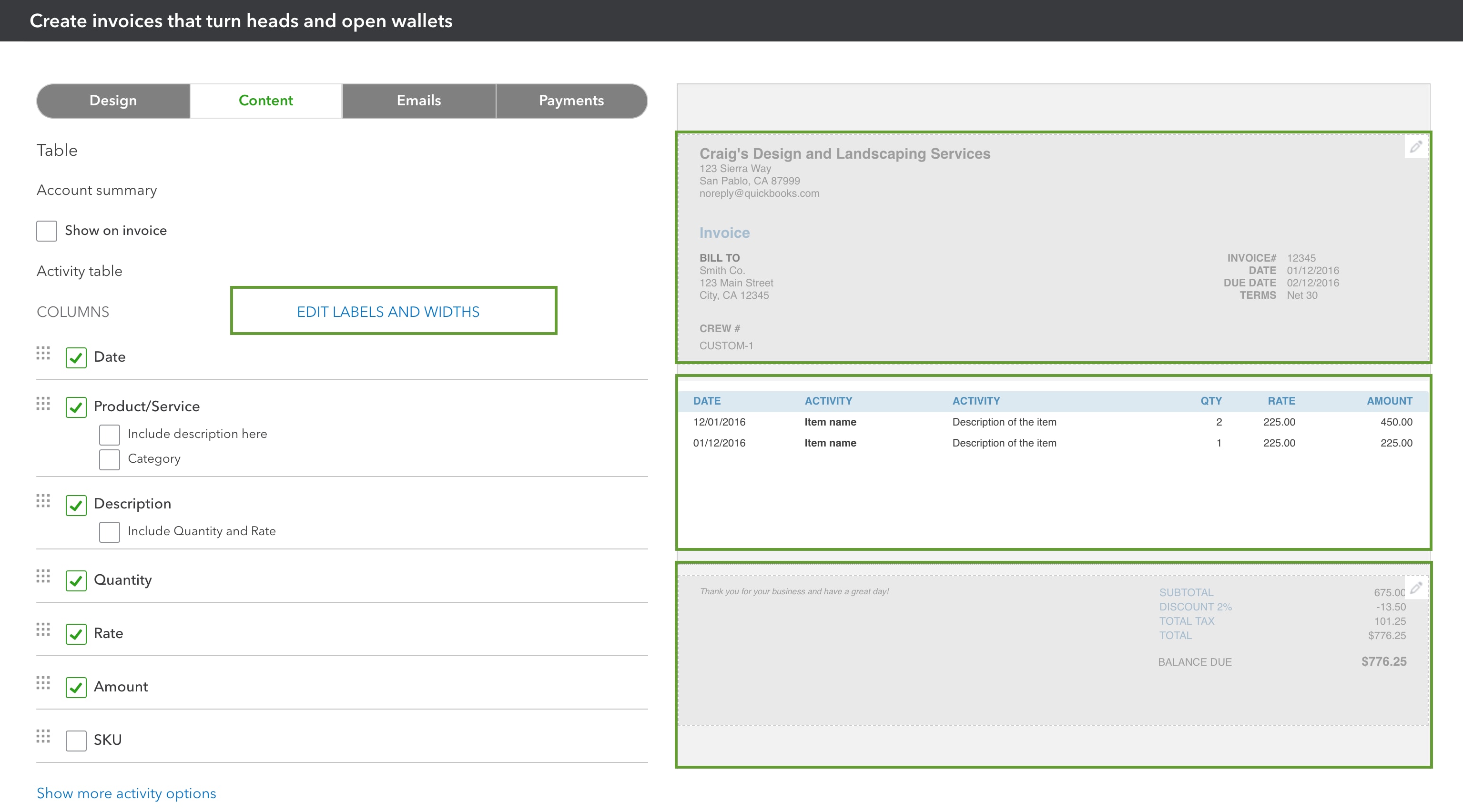

How to generate 1099 forms in quickbooks online. Enter the name and the email of the contractor in the Name and Email fields. QuickBooks Self-Employed QBSE helps track your income expenses mileage and tax info. Create Custom Invoice Template Quickbooks.

If you want the contractor to fill their own details check-mark. Select anywhere to refresh the report. Click 1099 contractors below the threshold.

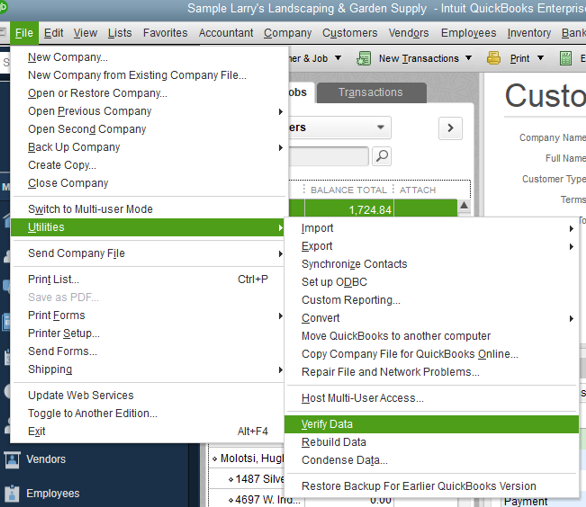

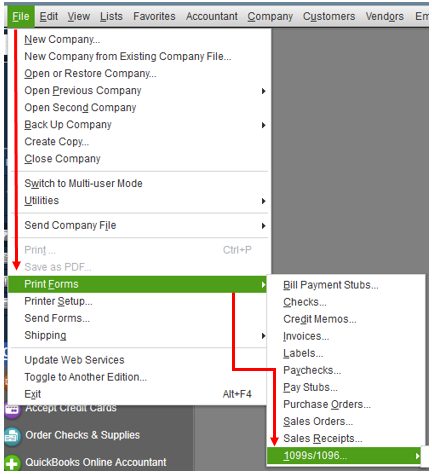

Select Print Forms from the drop-down menu then select 1099s1096 from the list. From the Sort by drop-down menu select Track 1099. Click the Vendors tab in the main menu then select Vendor Center from the pull-down menu.

Select Contractors from the sub-menu and then click Add your first contractor. Select the Sort drop-down menu. Click on the Workers tab then select Contractors.

Select all or select only the 1099 forms you want to submit. Select vendors who need 1099 and click on Continue. Generate a 1099 Form For a Vendor.

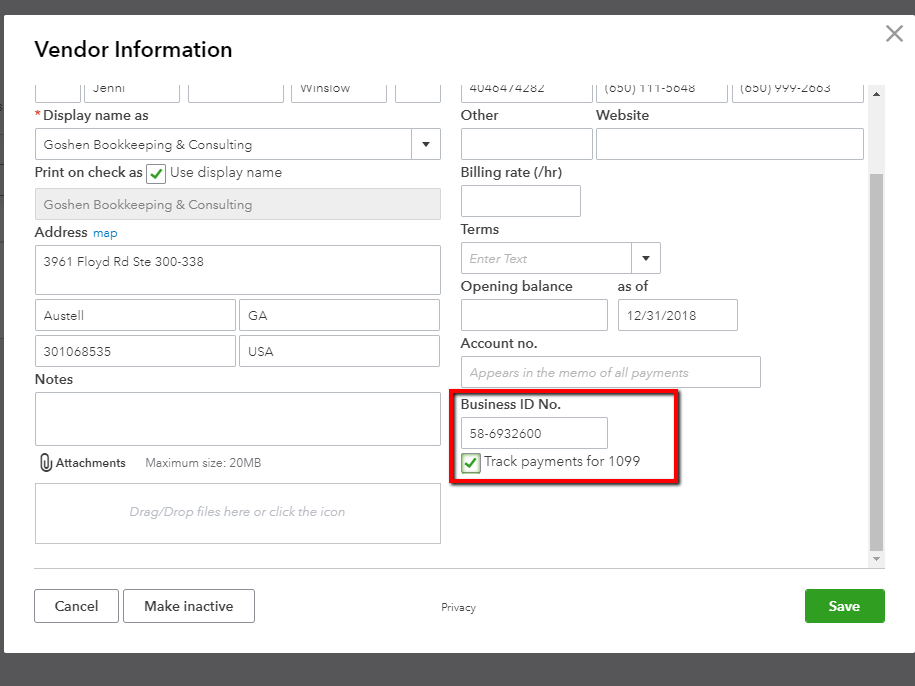

In this video we will review the 1099 wizard that QuickBooks Online Plus provides for processing 1099 forms for your independent contractorsIf you enjoyed t. Click Finish preparing 1099s. Select the Track 1099 checkbox.

Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors. Search for Vendor Contact List and open the report. To generate the 1099 Transaction Details Report you will need to pretend like you want to process your 1099s through QuickBooks Online.

Lets go through the process of setting up the 1099 preferences. Once verified select Continue. You can update any section by double-clicking on it and editing the incorrect fields.

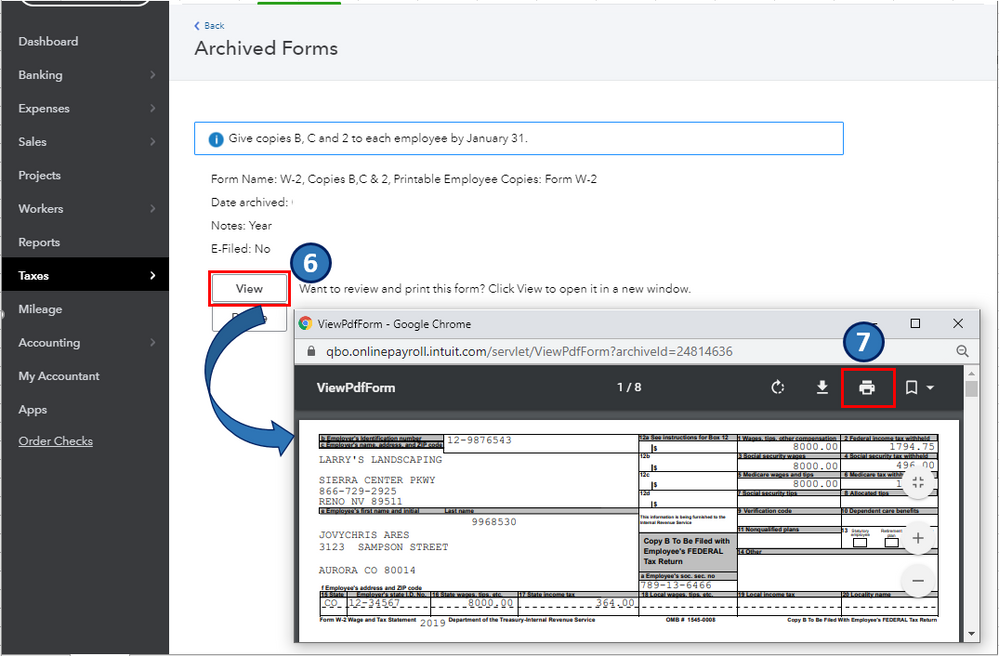

This way you can add your contractors details and file their 1099-MISC forms to the IRS. 3 Select the contractor for whom you want to generate a 1099 then click Print 1099 A preview of the 1099. Check whether vendor information is appropriate.

According to the IRS contractors are workers that are not considered employees because they dont perform work that the company could do on their own. Using QBs desktop here is the answer to the important question how do I run a 1099 report in Quickbooks How to find and produce 1099 reports in Quickbooks Heres how to get the report that lists all of your 1099 vendors. However creating 1099 forms for your contractors inside the program is unavailable.

Click on the Apply. Verify your 1099 Forms then select Continue. Create Multiple Invoices In Quickbooks Online.

This information isnt imported from QuickBooks Online. How To Create 1099 Forms In Quickbooks Online. From the left menu select Reports.

Select Expenses Vendors. Review your 1099 Forms and make sure that the information brought over from QuickBooks Online is correct. Go to Step number 4 by clicking Next.

The first time you run this report you will receive a blank page. If you want to sort the report by 1099 vendors. From the main dashboard click the Workers tab on the left-hand side.

How to prepare and print 1099 forms from QuickBooks Online. To change whether you track a vendor for 1099s update the vendor on your vendor list. Go to the Workers menu.

Click on PrintE-File 1099 Forms. Choose the Contractors tab. Contractors will also have to receive Form 1099-MISC though if they are paid a minimum of 600.

Launch the QuickBooks 1099 wizard from the File menu by clicking Print Forms and 1099s1096 Step 2 Check the Create Form 1099-MISC box for each 1099 vendor. Once there go to the Type of contractors drop-down arrow. Create Batch Invoices In Quickbooks Online.

Click the Prepare 1099s button. You can pay contractors through QuickBooks Onlines Payroll system.

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

Customize Invoices Estimates And Sales Receipts

Customize Invoices Estimates And Sales Receipts

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions