What Is Best 1099 Or W2

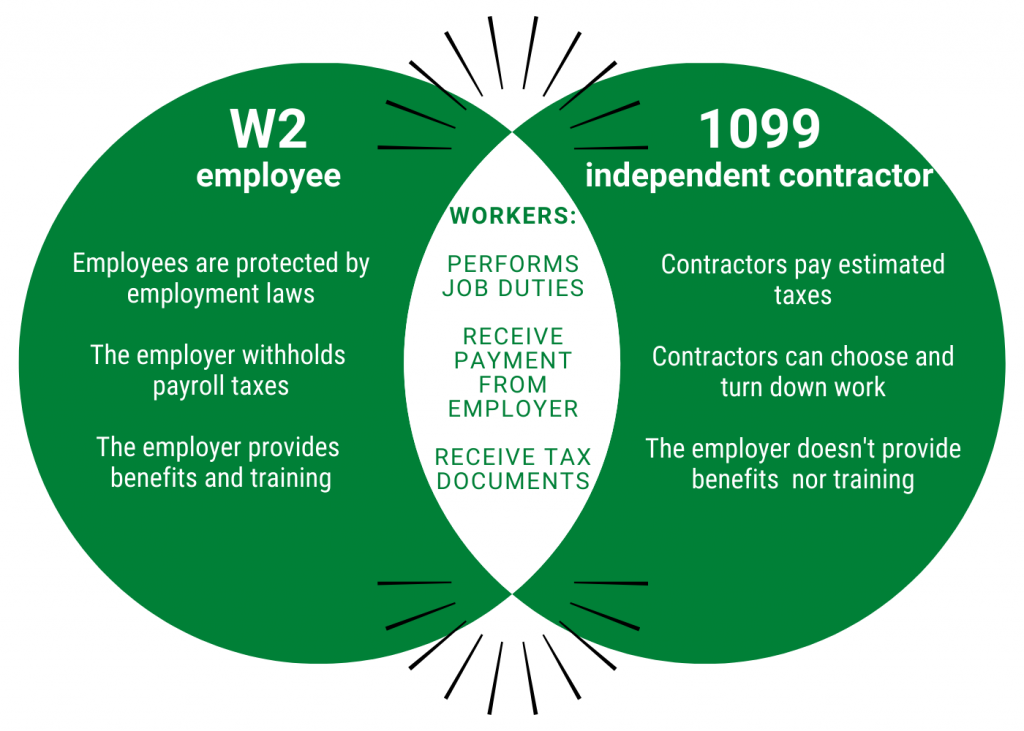

Press question mark to learn the rest of the keyboard shortcuts. W2 employees because contractors receive the 1099 tax form at the end of each year while employees receive a W2 form.

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

It shows the same basic information in addition to total taxes and other deductions withheld.

What is best 1099 or w2. When you hire an employee to work for you you can either pay them as a contractor or as an employee. The biggest distinction between W-2 and 1099 workers is the amount of control you have over them. If W2 income 7000 and 1099 income 7500 is it tax.

When you are paid by clients and file a form 1099 at tax-time youll be required to pay the employers-share of these taxes meaning that the full 153 comes out of each client payment you receive. Employees receive Form W2. 1099 workers are also known as self-employed workers or independent contractors.

Employees are called W2ers based on form W-2 while contractors are nicknamed 1099ers after form 1099. Advantages of 1099 employment include. That means giving instruction and providing the tools training and equipment to complete the work.

Contractors receive Form 1099 which shows the workers name Social Security number address and total earnings for the year. Messenger 1099s and W-2s are the tax forms employers use to report wages and taxes withheld for different workers. You also determine what they will be paid as a.

In the vast majority of cases the deductions reported on a W2 are left blank on a 1099 Form. Updated December 04 2019. For tax purposes if you classify a worker as an independent employee you must have a sound reason for that decision.

A 1099 contractor will often have a more complex skill set than other typical employees and are used more infrequently. 1099 or W2 Employee. Being a 1099 or W2 employee comes with benefits and drawbacks.

In other words you determine when they work how the work is conducted and what work specifically they will be performing. They must pay both employer and employee taxes on their income. If your employee prefers flexibility and independence a 1099 agreement may be best for them.

Federal Labor Law Protection. Ultimately whether or not you agree to work as a 1099 contractor or a W2 employee depends on your personal skills. The best way to classify them is as non-employees who are working for a business on a non-permanent basis.

Henceforth a 1099 worker pays much less tax as compared to a W2 worker. Here are some tips to decode these two forms and what to expect when preparing your taxes. The Blueprint takes a closer look at this for employees and small business owners.

As a W2 employee your employer pays 765 of your Medicare and Social Security taxes and you pay 765. It is unusual for an employer to deduct income taxes benefits or FICA on a 1099-MISC. You also set their hours and schedules.

When youre talking about a full-time W2 employee you as the business owner are in charge. When your business needs a specialized job or project completed that doesnt require ongoing work contract workers are often the best choice. W-2 workers are also known as employees.

Both scenarios have their own unique pros and cons for employers as well as individuals. While a W2 employee considers themselves a part of your organization a 1099 worker is the owner and employee of their own business. A shorthand way to consider this employment relationship is 1099 vs.

Press J to jump to the feed. In the past it was usually a better tax choice to be a W-2 employee than to be self-employed because employees paid. The growth in popularity of using 1099 vs W2 employees is due to the many advantages they offer.

A 1099 worker receives tax deductions such as business mileage work phone office expenses and much more. The 1099 vs W2 distinction is what separates employees from the self-employed. With a W-2 employee you have the right to direct the work being performed.

These workers receive a 1099 form to report their income on their tax returns. More free-spirited individuals might prefer a 1099 lifestyle while those looking for stability crave the structure spirit W2 employment. The IRS penalty per statement for failure to file or to failure to furnish accurate Forms W-2 and 1099 including accurate names and Social security Numbers is.

Differences in taxation benefits administration performing the work and more are all impacted by the arrangement you choose to enter into with your new employee. A 1099 worker has the liberty to charge on an hourly basis. W2 income about 14500 tax return about 6000.

Some of us have opportunities to work as either a W-2 employee or a 1099 contractor or even to be self-employed as a small business owner. Why Would an Employer Want to Hire a 1099 vs W2 Employee. Both the Form W-2 and Form 1099 serve a similar purposeto report income you earned from sources throughout the tax yearbut each is issued under different circumstances and requires slightly different approaches for tax season planning.

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

W2 Vs 1099 Which Is Better Contract Workers Vs Employess

W2 Vs 1099 Which Is Better Contract Workers Vs Employess

W2 Vs 1099 Workers What S The Best For Your Business Camino Financial

W2 Vs 1099 Workers What S The Best For Your Business Camino Financial

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

2019 Review Of W2 And 1099 Systems Cpa Practice Advisor

2019 Review Of W2 And 1099 Systems Cpa Practice Advisor

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

W 2 And A 1099 Here S What To Know Trinity Global Financial Group

How W2 Employees Are Taxed Differently Than 1099 Contractors

How W2 Employees Are Taxed Differently Than 1099 Contractors

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Should You Choose 1099 Or W 2 Independent Contractor Tax Advisors

Should You Choose 1099 Or W 2 Independent Contractor Tax Advisors

When To Switch Employees From A W2 To A 1099

When To Switch Employees From A W2 To A 1099

Pros Cons 1099 Vs W2 Eagle Employer Services

Pros Cons 1099 Vs W2 Eagle Employer Services

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

2019 Review Of W2 And 1099 Systems Cpa Practice Advisor

2019 Review Of W2 And 1099 Systems Cpa Practice Advisor

What S The Difference Between A W2 Employee And A 1099

What S The Difference Between A W2 Employee And A 1099

W2 Vs 1099 What Employers Need To Know About This Apples And Oranges Comparison Free Ebook Employers Resource

W2 Vs 1099 What Employers Need To Know About This Apples And Oranges Comparison Free Ebook Employers Resource