Which Is Better 1099 Or Llc

Both are business types but an independent contractor is comprised of one person or member while an LLC can have one or more members. First off with a 1099 you pay Income Tax and Self Employment tax but the main thing you have to look at is that your LLC has the right election to avoid self employment taxes.

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

Yes the gig economy think driving for UberLyft delivering food with GrubHub and more is skyrocketing with many Americans partaking.

Which is better 1099 or llc. I am thinking of getting a Business name for my 1099 convert into LLC because I heard you can get more deductions as an LLC than just 1099. Your client may prefer this instead of 1099 as it protects them from the risks regarding the employer-employee relationship even though you are paid via 1099 the IRS might still consider you an employee and disallow your independent contractor status. 1099 contractors need to treat their service as a business.

I just submitted 2016 taxes using only my SSN filing. Many businesses make decisions about whether to hire full-time or part-time employees or independent contractors as their business expands. And a great way to prove youre contracting work is a business is by forming an LLC.

In addition to that your taxes wont become much more complicated and youll enjoy the limited liability of any other LLC or corporation. If your LLC is a disregarded or Single member LLC you really need to look at that election one more time to see if its convenient to change it and save more in taxes. First a few definitions.

If youre a regular employee full-time or. Otherwise they or their clients could get into trouble. In addition if 1099 status goes on for more than several weeks the IRS may disallow independent contractor status and seek back taxes from the employer.

Second an LLC allows you to deduct business expenses off the top prior to determining what you pay in taxes as pass-through income. Each will need to take careful inventory of their long-term goals in order to decide accordingly. Payments for which a Form 1099-MISC is not required include all of the following.

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. When it comes to the 1099 vs. Probably the biggest reason a 1099 employee would want to create an LLC is to have the personal liability protection that the LLC provides.

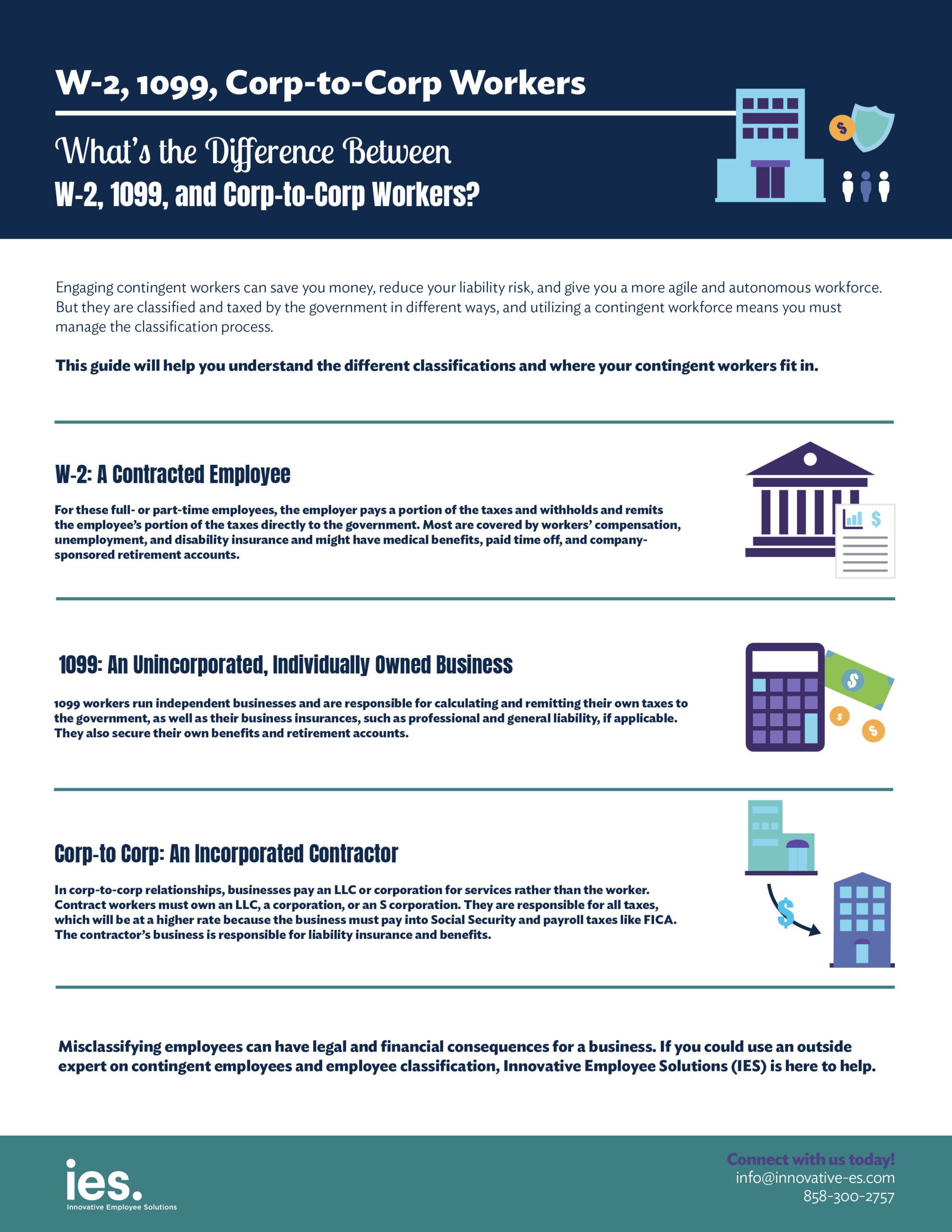

With a corp-to-corp instead of the employer paying the contractor directly the contractor must have an LLC limited liability company set up which the employer pays instead. The 1099 vs W2 distinction is what separates employees from the self-employed. The Pros and Cons of 1099 vs W2 There are many different types of workers from temporary full-time part-time to freelancinggig economy work.

The Blueprint takes a closer look at this for employees and small business owners. Form 1099-MISC although they may be taxable to the recipient. With 1099 you pay the same taxes regardless of your business expenses unless they are specifically allowed as a 1099 contractor which most are not I believe.

1099 vs W2 Workers. I am in Florida. However see Reportable payments to corporations later.

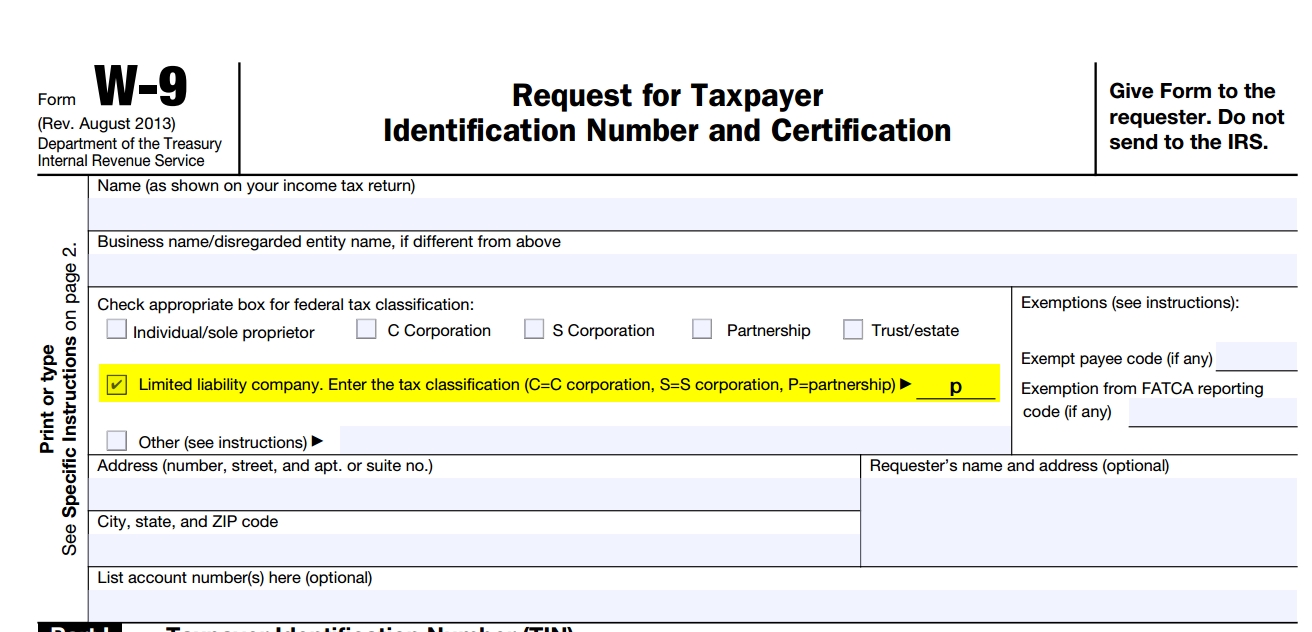

It has since changed and is the main and only source of income for me. In fact its way better. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC.

The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. Independent contractor vs LLC refers to the differences between an independent contractor and a limited liability company. There can certainly be advantages for a 1099 employee creating an LLC.

Weve highlighted some of the main reasons that 1099 employees decide to create an LLC below. However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. W2 debate it can be tough for both workers and companies to choose which route to take.

There are a number of reasons you might want to hire one over the other but lets first discuss the main differences between a W2 employee and a 1099 contractor. Jack Wolstenholm is the head of content at Breeze. I had a business I ran as a sole proprietor for about 4 years that hadnt made too much and was not a problem to add to tax returns as it was only 1099-MISC income.

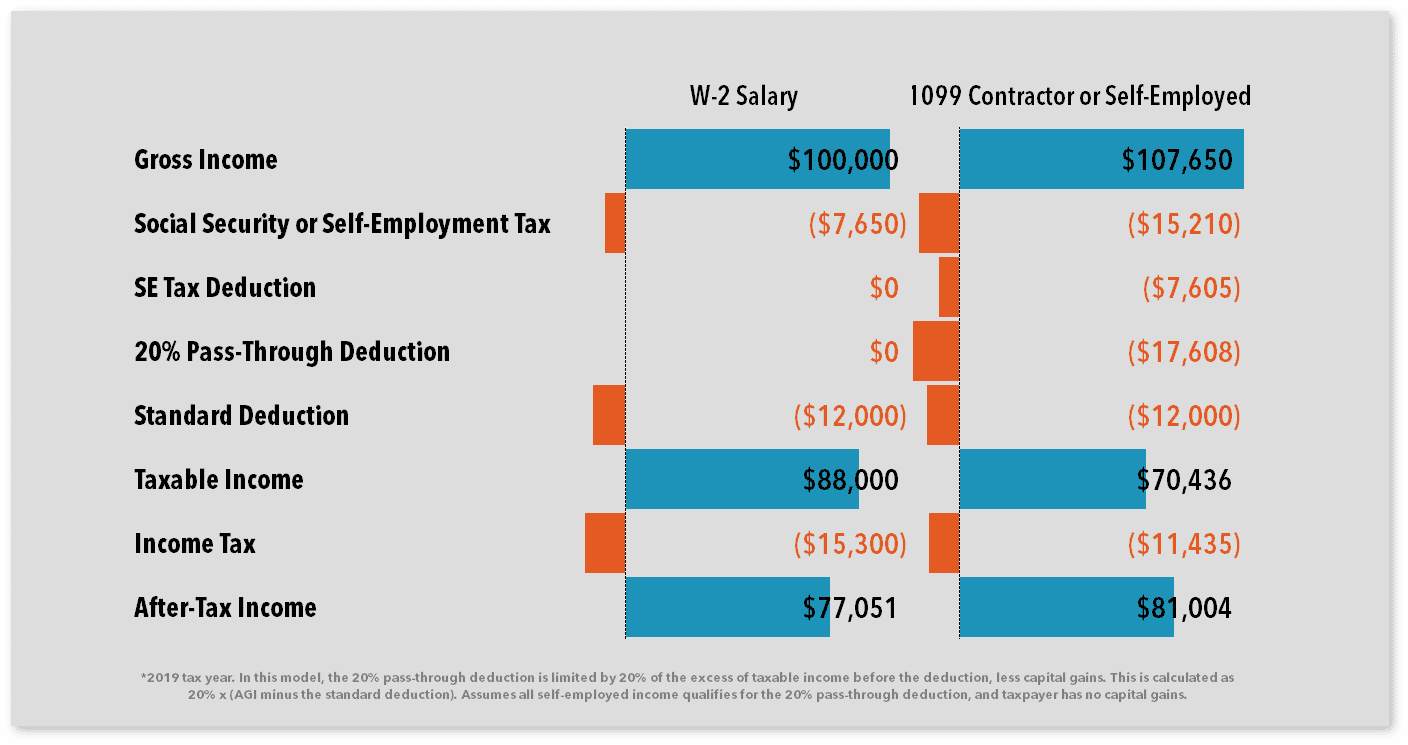

Even though an LLC can file an election with the IRS to be taxed like a corporation your business may not be aware of the LLCs current tax status so its usually safer to issue a 1099 to any LLC that you pay more than 600 on an annual basis. I registered the business as an single member LLC a year ago and requested an EIN a few months ago. A 1099 contractor or self-employed individual with a median salary can now save thousands of dollars in taxes with the pass-through deduction.

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Vs W2 Difference Between Independent Contractors Employees

![]() Single Member Llc Defined Excel Capital Management

Single Member Llc Defined Excel Capital Management

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

What S The Difference Between W 2 1099 And Corp To Corp Workers

What S The Difference Between W 2 1099 And Corp To Corp Workers

Should An Independent Contractor Incorporate As An Llc Or S Corporation Epgd Business Law

Should An Independent Contractor Incorporate As An Llc Or S Corporation Epgd Business Law

Let S Do W 9s And 1099 S Better In 2019 Berkshirerealtors

Let S Do W 9s And 1099 S Better In 2019 Berkshirerealtors

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Llc California How To Start An Llc In California

Llc California How To Start An Llc In California

Why Independent Contractors Should Form An Llc Domyllc

Why Independent Contractors Should Form An Llc Domyllc

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

Independent Contractor Physician Llc Or S Corp Apollomd

Independent Contractor Physician Llc Or S Corp Apollomd

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

S Corp Or Llc For Independent Contractor Guide

S Corp Or Llc For Independent Contractor Guide

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Limited Liability Company Llc And Foreign Owners Epgd Business Law

Limited Liability Company Llc And Foreign Owners Epgd Business Law

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax