What Expenses Can I Claim As A Self Employed Driver

Truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Here are a few that Stride wants all delivery drivers to know about.

Taxes For Turkers Reporting Self Employment Income Mturk Crowd Mechanical Turk Community Forum Self Employment Income Employment

Taxes For Turkers Reporting Self Employment Income Mturk Crowd Mechanical Turk Community Forum Self Employment Income Employment

Train bus air and taxi fares.

What expenses can i claim as a self employed driver. Your biggest tax deductions will be costs related to. Mar 05 2021 As a rideshare driver you can claim a tax deduction for the miles you drive on the job. You can claim allowable business expenses for.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Parking charges fines are not allowed. Jan 25 2020 Expenses that are not part of the normal operation of your vehicle are claimable.

If you use the standard mileage rate youll deduct 0575 per mile driven for business. Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Typically most of the things that you pay for as a driver will be tax-deductible for example.

Your license and any other registration fees. The cost of washing or cleaning your own vehicle. Mobile phones data plans and mobile phone accessories chargers cradles and mounts Vehicle expenses or standard mileage.

Bike maintenance such as brake pads tyre replacement. The costs of your annual road tax and your MOT test. Interest on any bank or personal loans taken out to purchase your vehicle.

You can deduct common driving expenses including fees and tolls that Uber and Lyft take out of your pay. Feb 16 2017 Whether youre a courier for Postmates Amazon Flex DoorDash or any other delivery service youve got business expenses that you can deduct from your delivery income. Interest on any loans taken out to pay for.

Your license and any other registration fees. However local truck drivers typically cannot deduct travel expenses. Vehicle insurance and AARAC membership are both eligible expenses as well.

Mileage daily meal allowances truck repair maintenance overnight hotel expenses and union dues are some of the tax deductions available. Deliveroo commissions and service charges. Self-employed individuals can deduct their non-commuting business mileage.

Mobile phone phone holder. Sep 13 2017 Claiming for allowable business expenses is the easiest way to reduce your uber taxes when youre self-employed. Car wash cleaning and detailing.

As an Uber Lyft or other self-employed driver you can deduct these work-related expenses in addition to the ones listed above. The IRS considers a semi-truck to be a qualified non-personal-use vehicle. If a taxpayer uses the car for both business and personal purposes the expenses must be split.

The cost of washing or cleaning your own vehicle. Interest on any bank or personal loans taken out to purchase your vehicle. There are two methods for figuring car expenses.

May 25 2019 Driver. Alternately you can use the actual expense method to deduct the business portion of costs like gas repairs and maintenance auto insurance registration and car loan interest or. Taxes and deductions that may be considered ordinary and necessary depends upon.

Office and admin expenses. As a self-employed individual there are certain essential business costs which arent taxable by HMRC. If you use the actual expense method to calculate the deduction youll add up all your vehicle-related costs and deduct a certain percent of the total.

Feb 01 2018 If you purchased your tax using a personal loan or a bank loan you can state the interest on the loan as an expense. You can also claim for any registration fees you have been subject to for example license fees. You can claim your business phone and data costs equipment and supplies and all other direct business expenses.

Couriers may be able to claim. Car purchase see below. The deduction is based on the portion of mileage used for business.

Jun 14 2017 Answer. As a self-employed worker tax deductions for business expenses are the best way to prepare an accurate tax return and lower your taxes. The costs of your annual road tax and your MOT test.

There are also some car-related costs that still can be claimed when taking the mileage deduction. For 2020 tax returns you can use the standard mileage rate to take a deduction of 0575 per business mile. Bank charges for.

Vehicle repair and servicing costs.

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

Home Office Deduction Worksheet Excel

Home Office Deduction Worksheet Excel

Diy In 123 Steps In How To Organize Receipts For Tax Season Receipt Organization Diy Taxes Tax Organization

Diy In 123 Steps In How To Organize Receipts For Tax Season Receipt Organization Diy Taxes Tax Organization

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

Freelancer S Guide To Car Tax Deductions

Freelancer S Guide To Car Tax Deductions

6 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

6 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

Studio Waterstone Keeping Track Of Expenses Scentsy Business Jamberry Business Business Expense

Studio Waterstone Keeping Track Of Expenses Scentsy Business Jamberry Business Business Expense

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

Tax Avoidance Vs Tax Evasion The Big Difference Taxes Taxplan Tax Services How To Plan Business

Tax Avoidance Vs Tax Evasion The Big Difference Taxes Taxplan Tax Services How To Plan Business

How Much Rideshare Drivers Actually Make In A Year The Bold Italic San Francisco Uber Driving Uber Driver Rideshare Driver

How Much Rideshare Drivers Actually Make In A Year The Bold Italic San Francisco Uber Driving Uber Driver Rideshare Driver

Self Employed Tax Preparation Printables Instant Download Etsy In 2021 Tax Prep Checklist Tax Preparation Small Business Tax

Self Employed Tax Preparation Printables Instant Download Etsy In 2021 Tax Prep Checklist Tax Preparation Small Business Tax

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

H And R Block Clarkesville Ga Georgia Corneliaga Shoplocal Localga Cornelia Georgia Income Tax Preparation Tax Preparation Tax Rules

H And R Block Clarkesville Ga Georgia Corneliaga Shoplocal Localga Cornelia Georgia Income Tax Preparation Tax Preparation Tax Rules

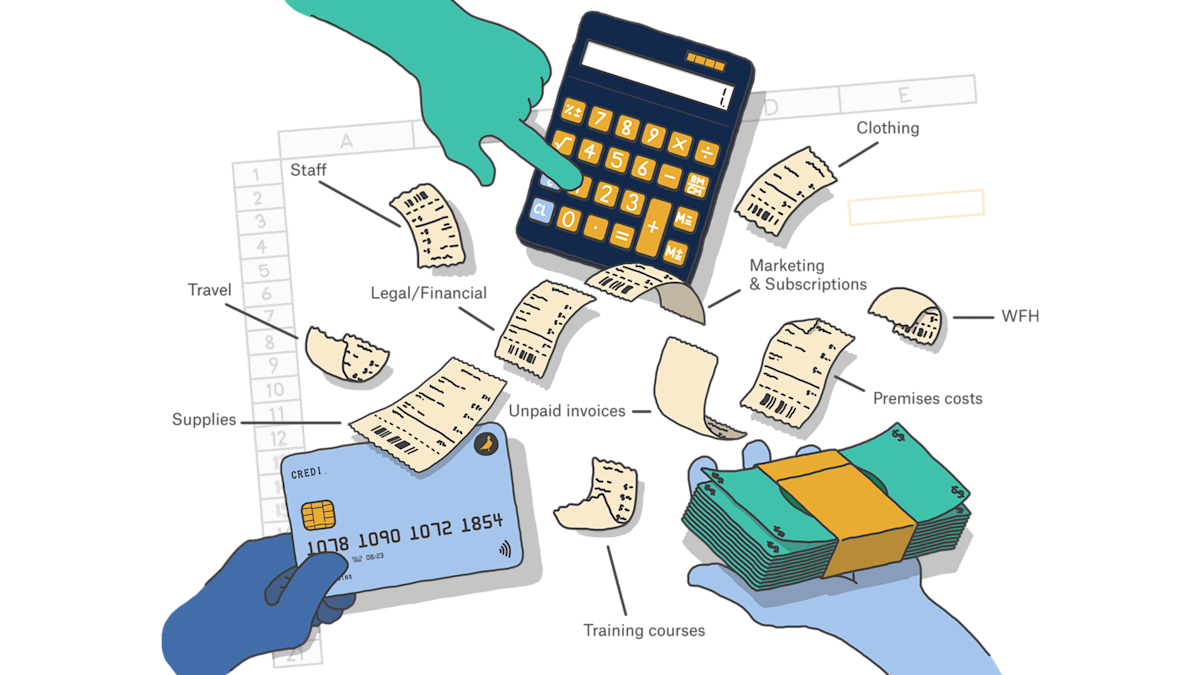

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

Tax Deductions For Your Online Business Expenses

Tax Deductions For Your Online Business Expenses

.svg)